Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

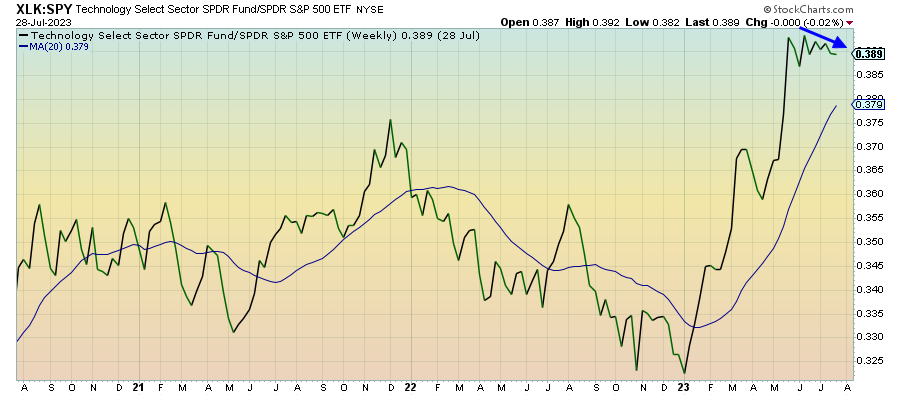

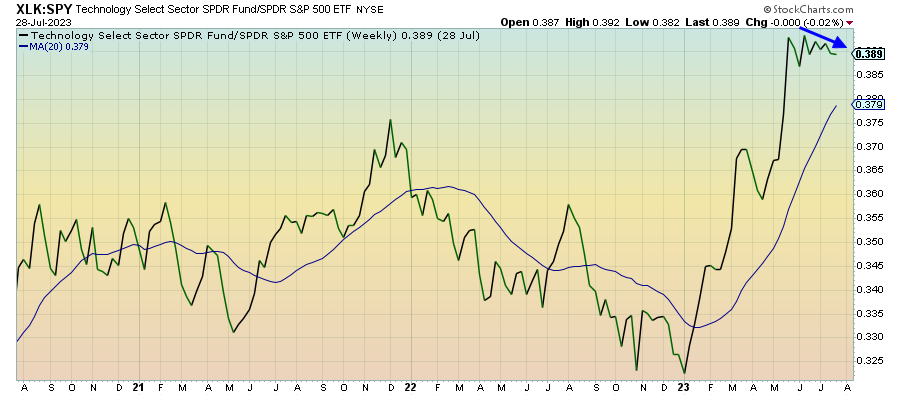

Technology (XLK) – AI Mania Is Over, but Gains Are Holding

The AI mania rally looks like it’s run its course, but there’s plenty of opportunity for another jolt with Apple (NASDAQ:), Amazon (NASDAQ:), PayPal (NASDAQ:), Advanced Micro Devices Inc (NASDAQ:), Qualcomm (NASDAQ:) and Coinbase (NASDAQ:) earnings coming later this week. As is the case with other growth sectors, the positive economic news is rotating investors over to areas of the market that traditionally perform better in recoveries, such as small-caps and cyclical. This sector (NYSE:) was due for a break, but it is holding on to gains for now.

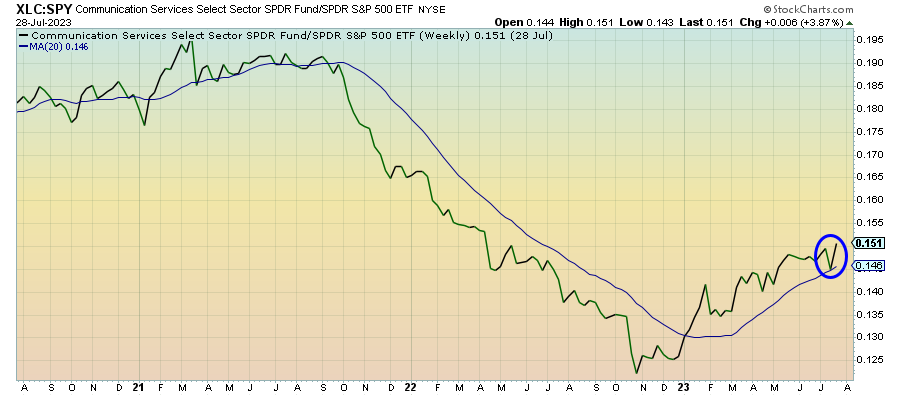

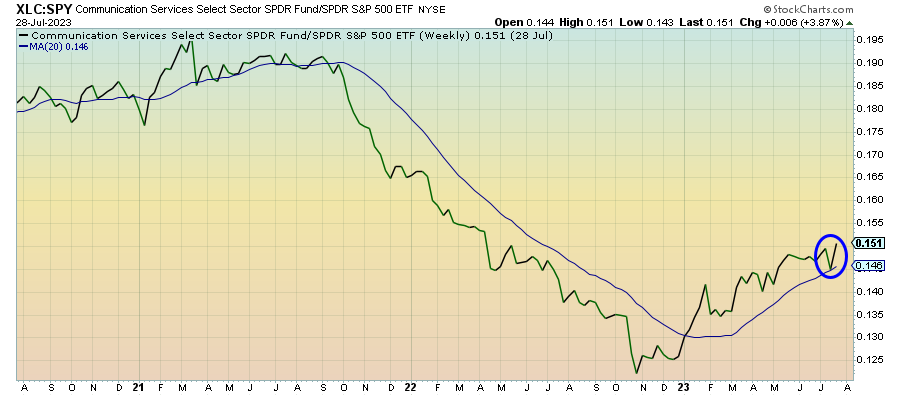

Communication Services (XLC) – The Earnings Jolt

Clearly, this is a Meta Platforms Inc (NASDAQ:) and Google (NASDAQ:) fueled bounce thanks to solid Q2 earnings reports that sent the stocks significantly higher. Those are typically one-time bumps and the sector (NYSE:) is likely to once again perform more in line with other adjacent growth sectors. That means some potential headwinds that could come as investors begin favoring cyclical again, but there’s enough positive here that we could see some carry through.

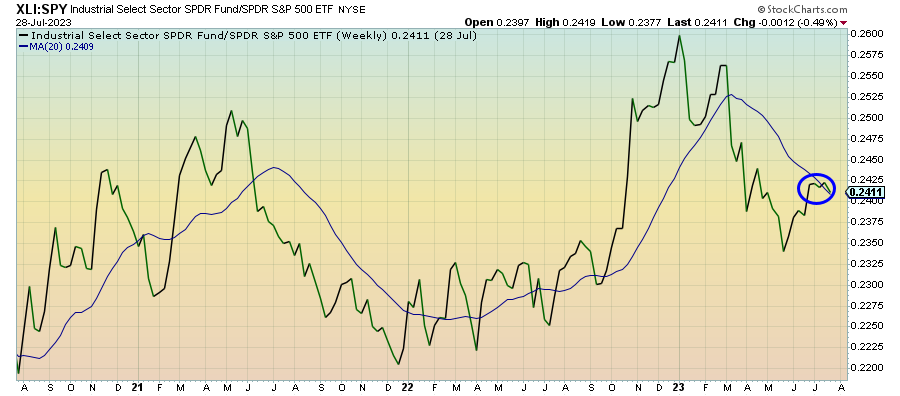

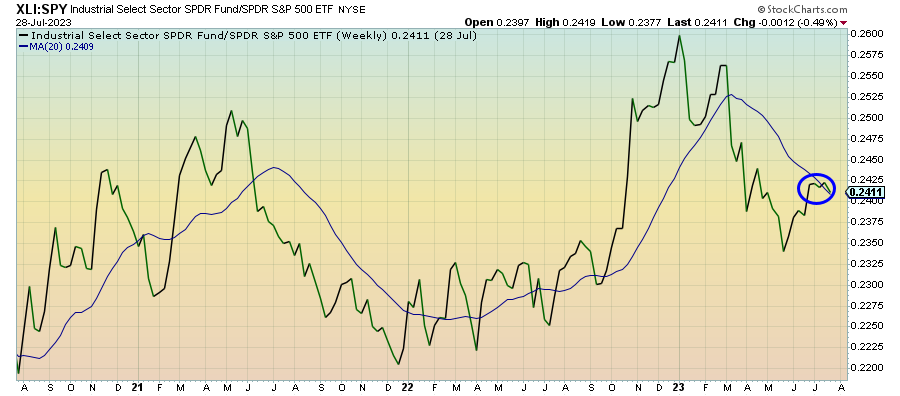

Industrials (XLI) – Steady Level of Support

Once the initial AI rally cooled off, industrials (NYSE:) was the one sector that benefited most. Now that the latest data has kept the momentum going, we’re seeing industrials hand off leadership to other cyclical areas of the market, such as financials and energy. As long as the economic data keeps rolling forward and we don’t get something unexpected, there’s probably a sturdy level of support for this sector even if it may not necessarily be a market leader.

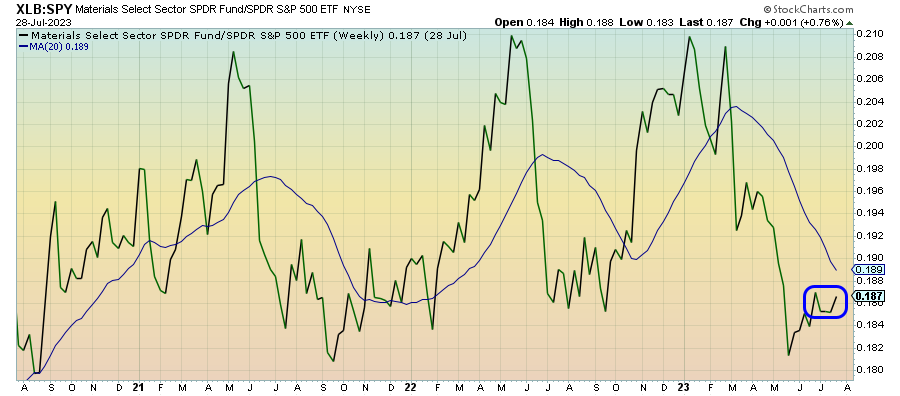

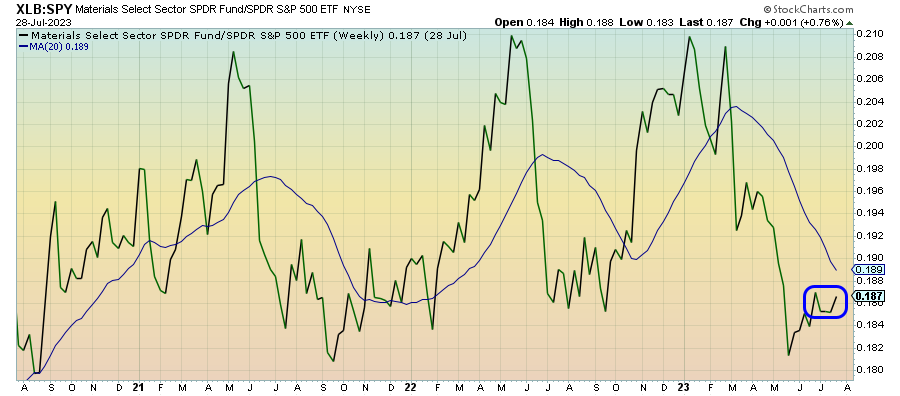

Materials (XLB) – Mixed Environment

Commodities (NYSE:) are actually mixed here with lumber prices taking a precipitous tumble last week, but materials stocks are still holding up. This sector is pretty clearly getting some benefit from the rotation into cyclical, but the overall tone looks more cautious than anything. Manufacturing has actually been picking up over the past month or two, so perhaps there will be some sustainability here.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link