- Meta Platforms reported outstanding earnings

- The stock has continued its charge upward ever since

- That raises the question, can the social media giant continue to report great numbers that sustain the stock’s rally?

Meta Platforms (NASDAQ:) has recently unveiled impressive for the second quarter of 2023. The future looks bright as operations and product offerings display tremendous growth potential, further solidifying the positive outlook.

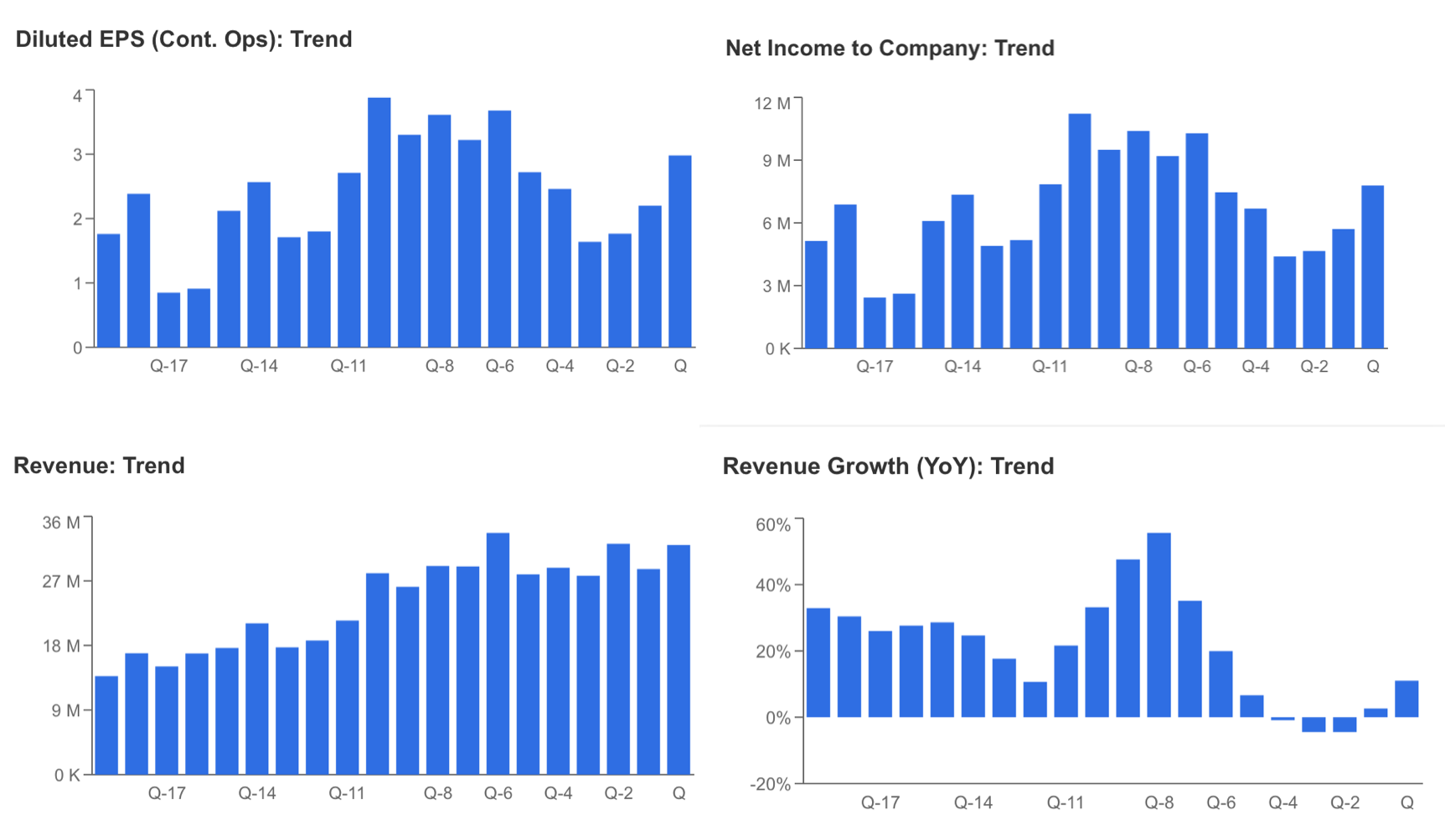

During Q2, Meta achieved a remarkable net profit of $7.8 billion, showcasing a substantial 16.4% increase compared to the previous year. But that’s not all – its earnings per share also surpassed InvestingPro’s expectations by 3.2%, coming in at $2.98.

And that’s just the beginning, as Meta’s revenue experienced significant growth, soaring to $32 billion, an impressive 11% year-on-year increase, surpassing InvestingPro’s projections by 3%.

Let’s delve deep into the details of the social media giant’s outstanding Q2 2023 performance and uncover the factors propelling it on an upward trajectory.

Source: InvestingPro

Following the release of its impressive financial results, Meta’s stock experienced a rally, closing the day at $311 with a substantial gain of nearly 6%. At its peak, the stock reached $325 after the report.

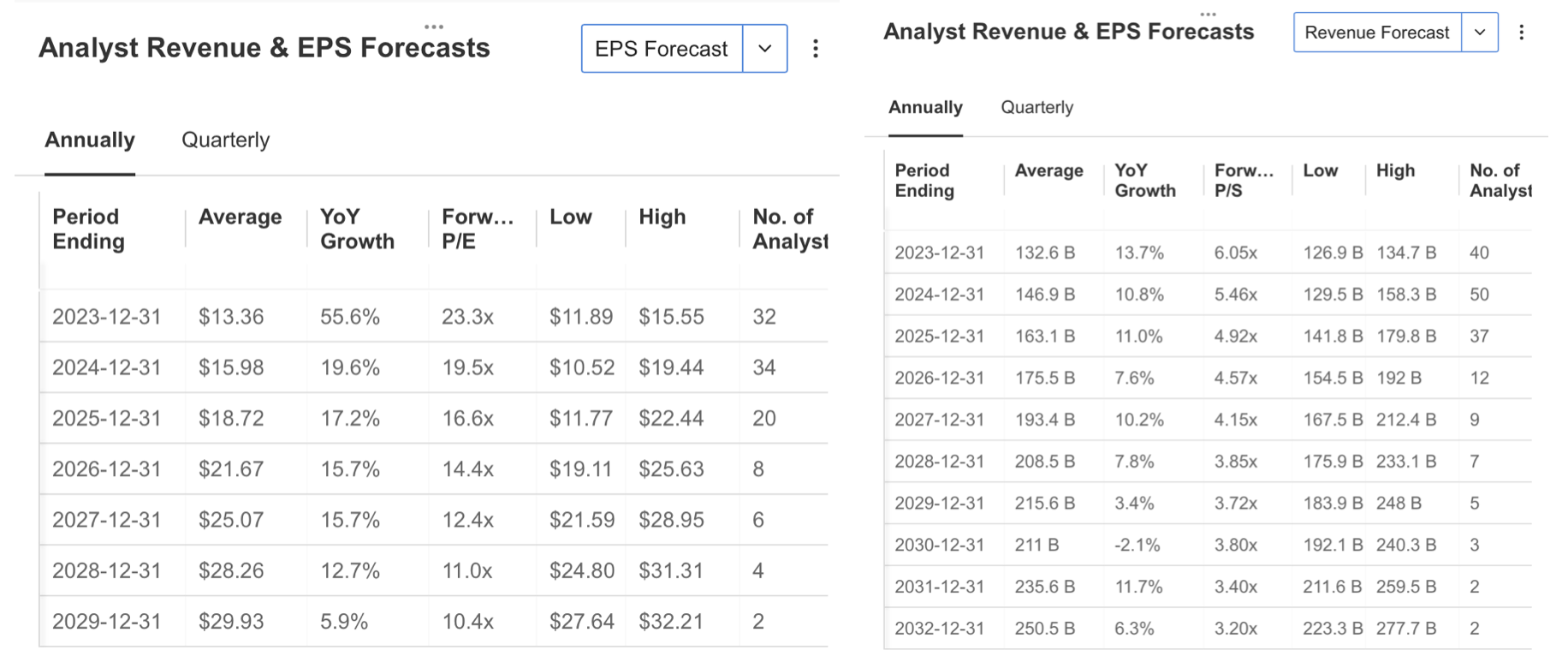

Looking ahead, analysts are optimistic about Meta’s prospects, as forecasts suggest that the company will continue to achieve growth in earnings per share and revenue throughout the remainder of the year.

Source: InvestingPro

By the end of the year, the company is forecasted to achieve earnings per share of $13.36, a 55.6% increase, and revenue of $132.5 billion, a 13.7% increase, as per analyst estimates.

Source: InvestingPro

In the Q3 assessment, 22 analysts revised their views upwards, indicating positive expectations for the company’s performance. As a result, Meta’s earnings per share (EPS) for the next quarter is estimated to be $3.56, and its quarterly revenue is projected to reach $33.3 billion.

Meta Earnings Highlights

During the last quarter, Meta demonstrated strong financials, with an 11% year-on-year increase in revenue, mainly driven by a remarkable 12% growth in advertising sales. Notably, marketing expenditures, which had dipped during the pandemic, surged again this quarter, with ad impressions rising by more than 30%.

Meta’s strategic restructuring efforts, which involved laying off around 21,000 employees and implementing efficiency and cost-cutting policies, have begun to yield positive results. The company achieved a noteworthy 16.4% increase in annual net income. Such encouraging results have further bolstered investor confidence in Meta’s prospects.

Looking ahead, Meta’s revenue projection for Q3 falls in the range of $32 to $34.5 billion. However, CEO Mark Zuckerberg issued a cautionary note, mentioning an increase in spending for 2024 as part of their ambitious plans for lucrative projects.

To support its future growth, Meta is investing in its social media platforms, Reels and Threads, and prioritizing artificial intelligence products and projects such as the Quest 3 virtual reality headset and Llama 2. Investors are optimistic that these initiatives will continue to drive the company’s development in the coming periods.

Despite the positive strides, Meta’s Reality Labs continues to incur losses. In the 2nd quarter, Reality Labs reported a loss of $3.74 billion, surpassing expectations. On the other hand, the revenues remained favorable, reaching $276 million.

Although the company invests heavily in the Metaverse, it has not yet generated profits in this area. As a result, the expectation is that Reality Labs’ annual loss may increase as Meta continues to scale the ecosystem.

In the Q3 assessment for META, 22 analysts revised their views upwards. Accordingly, META’s HBK in the next quarter is estimated at $ 3.56, and quarterly revenue is estimated at $ 33.3 billion.

Source: InvestingPro

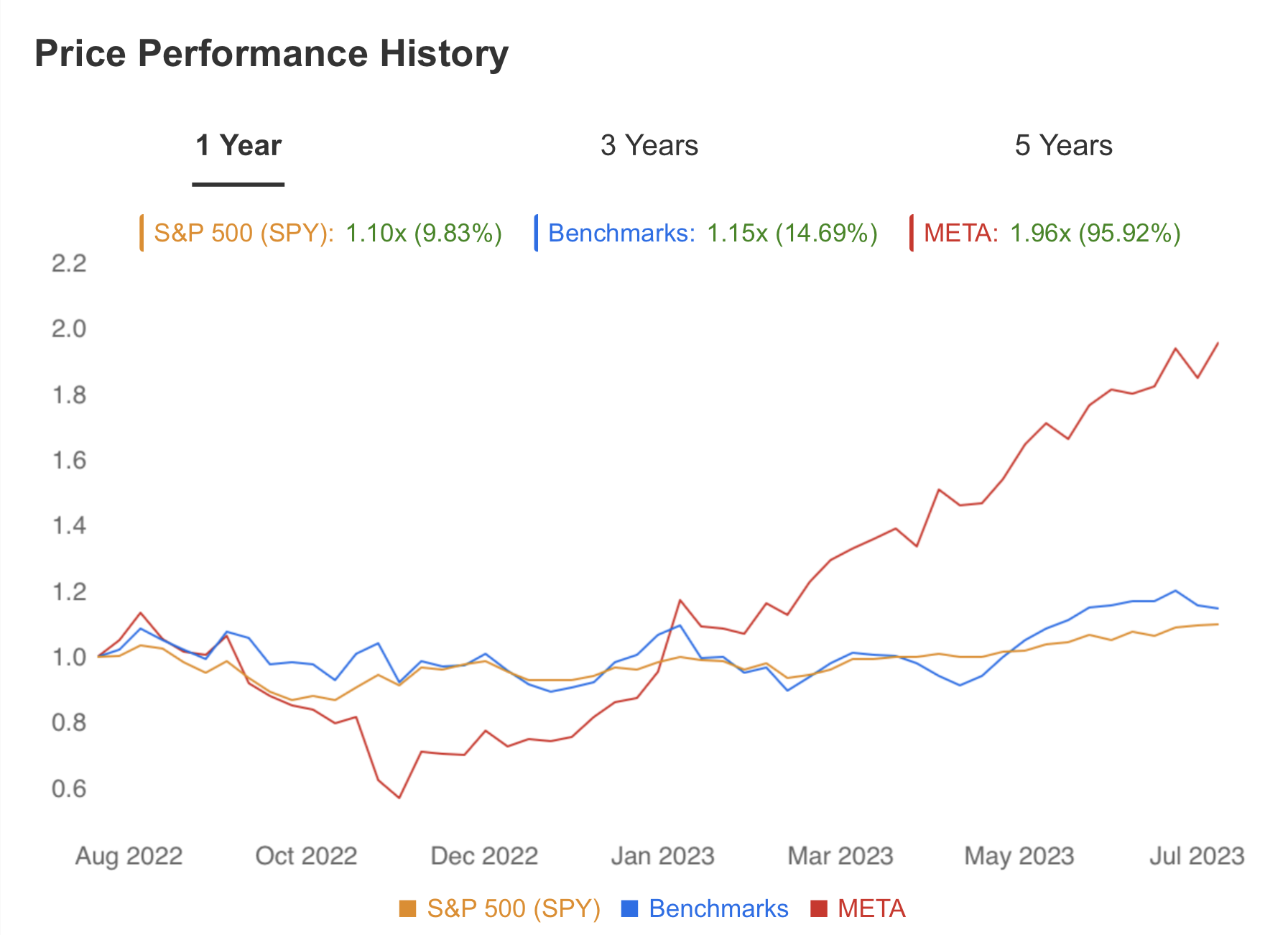

In November 2022, META broke free from its downtrend and embarked on a steep uptrend, setting the stage for a promising start in 2023. Over the past year, the stock has significantly outperformed its peers, decoupling from the sector average, which rose by 15%, and the , which recorded a growth of close to 10%. In contrast, Meta’s stock surged an impressive 96%.

Source: InvestingPro

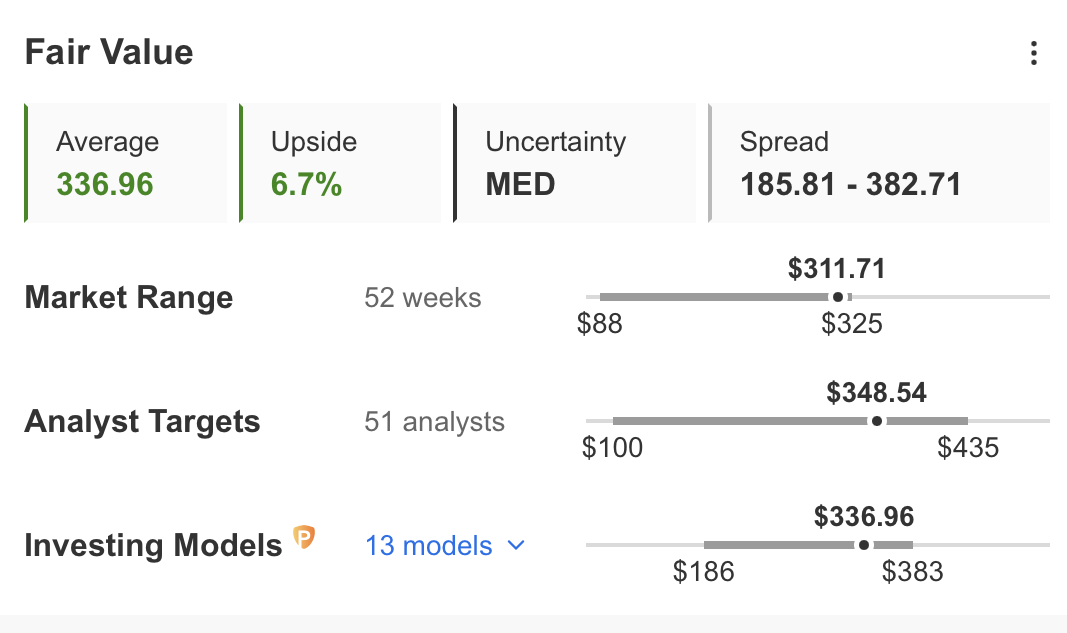

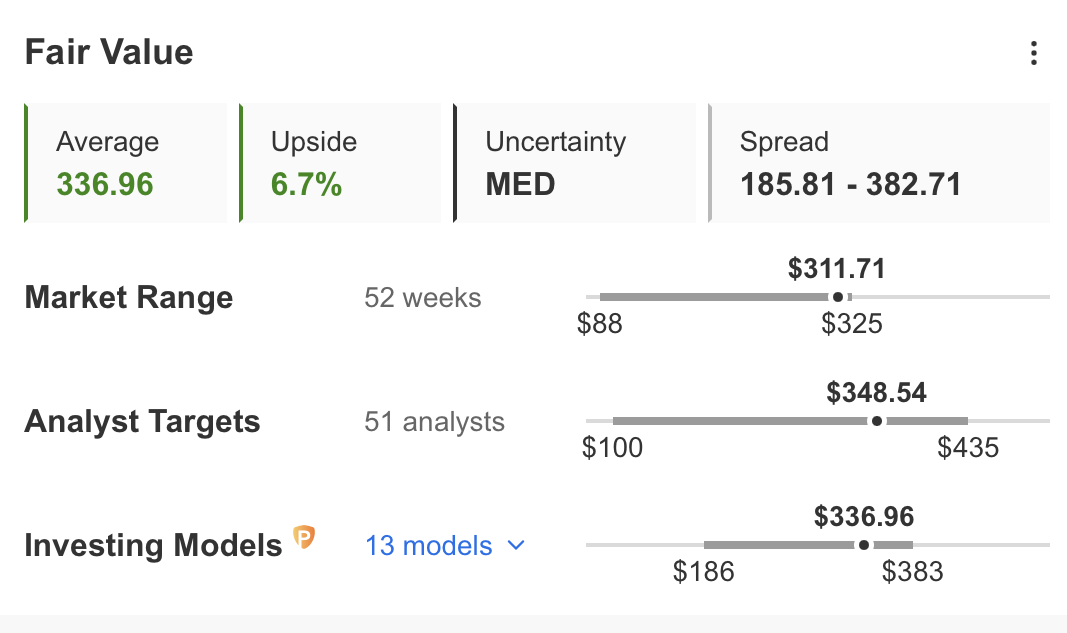

According to InvestingPro, META’s fair value, as calculated by 13 financial models, is estimated at $337, indicating that the current share price is trading at a discount of approximately 7% compared to this value. However, the fair value average projected by 51 analysts is even higher at $350, suggesting further upside potential for the stock.

The current data portray a positive outlook, as the company continues to deliver high returns, and its balance sheet shows a healthy cash position above its liabilities, instilling confidence among investors. Moreover, analysts’ upward revision of earnings expectations further adds to the positive sentiment surrounding Meta’s prospects.

On the other hand, it’s essential to be mindful of certain warning signs. Despite the positive aspects, Meta’s high price-earnings ratio and the fact that its earnings per share are still below the peak observed in 2021 should be considered.

Source: InvestingPro

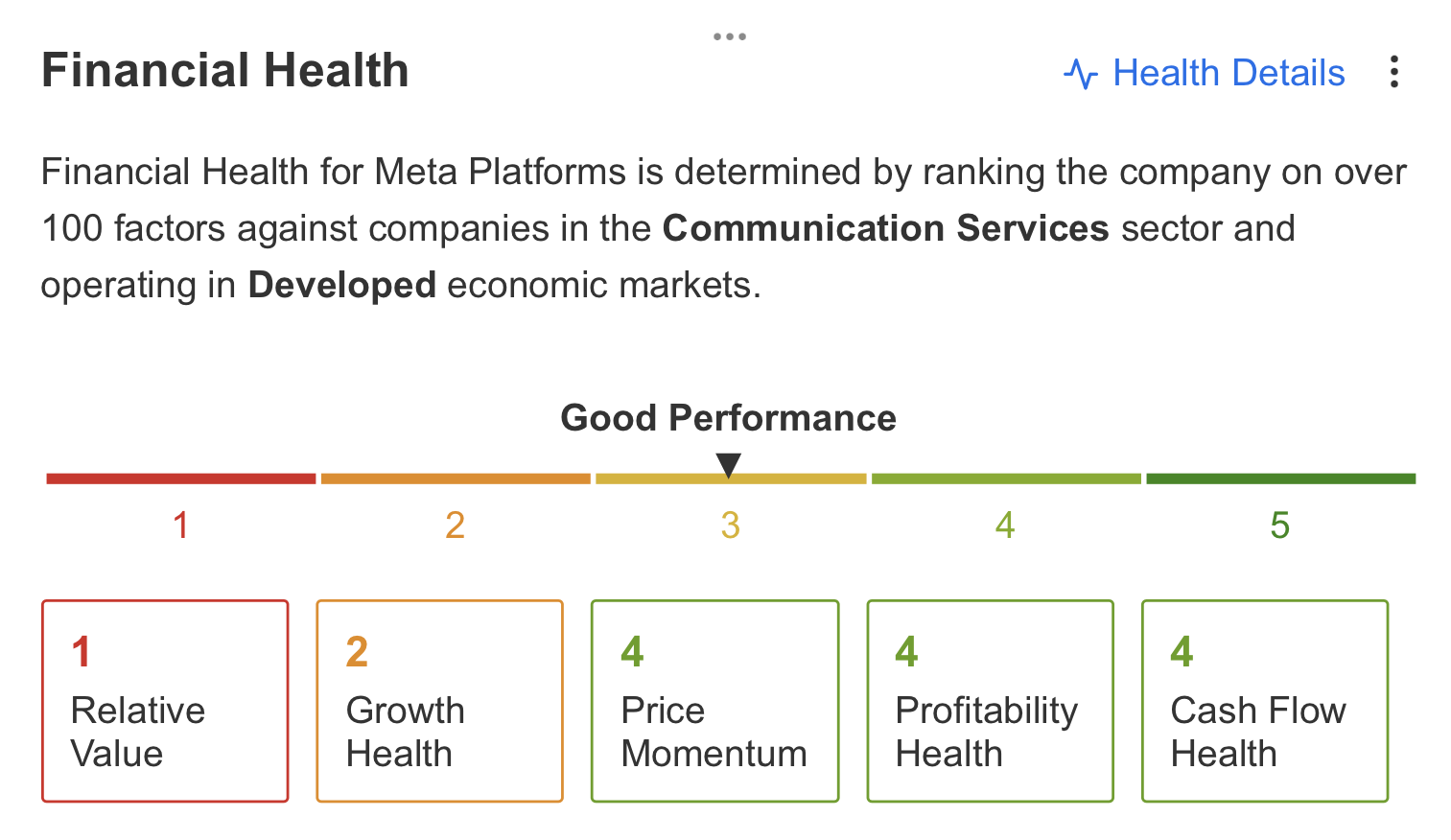

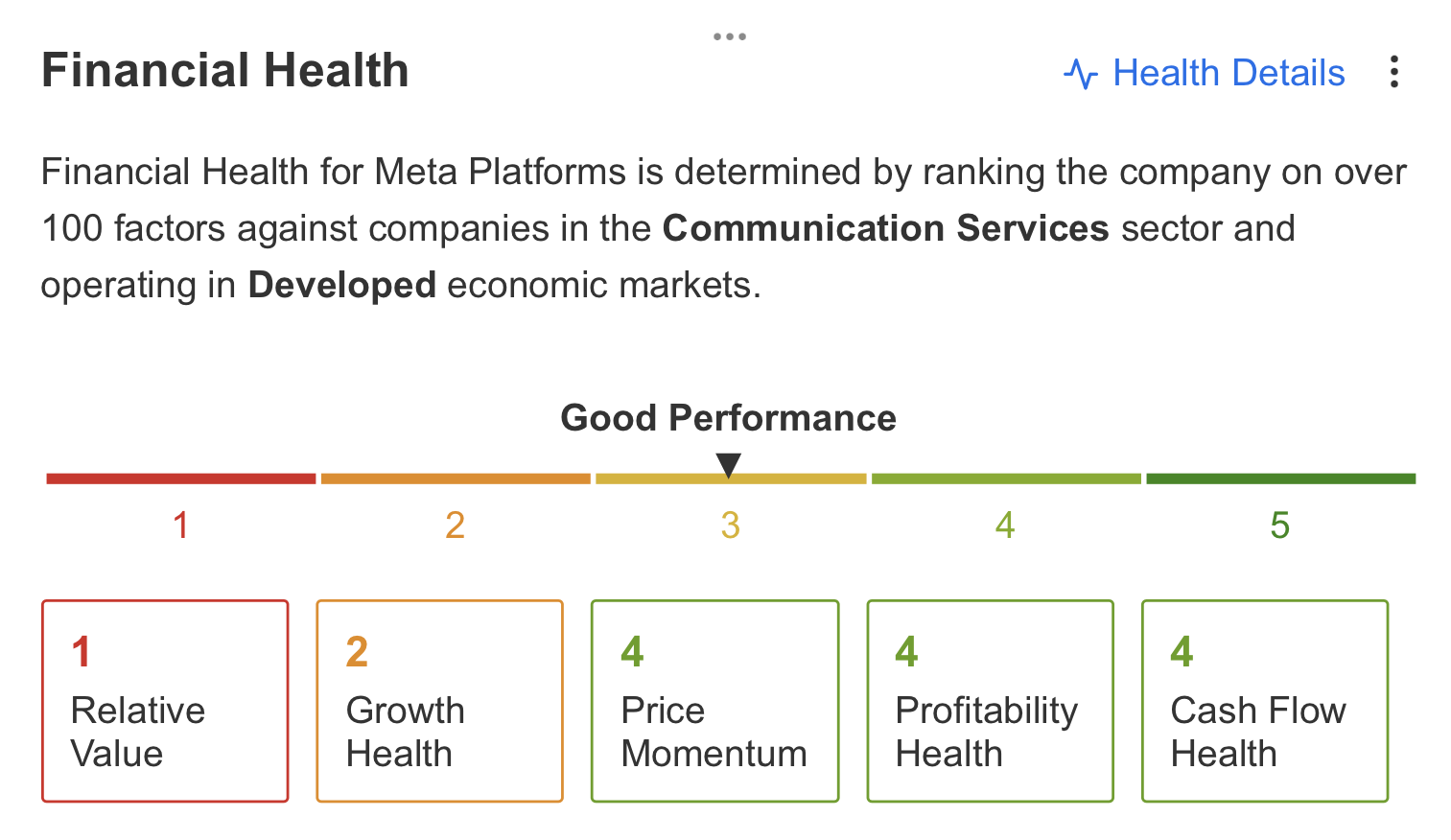

The company’s cash flow, profitability status, and price momentum are prominent strengths, reflecting Meta’s strong performance in these areas. On the other hand, relative value with growth health appears to be a potential handicap, indicating room for improvement in this aspect.

Meta continues to fare well in its financial standing, with favorable indicators in cash flow, profitability, and price momentum. While there are areas for potential growth, the company’s current performance is robust and highlights its overall positive trajectory.

Meta Stock: Technical View

META’s surge in 2023 boosted the broader market. With the rally starting in November, the stock surged by almost 235%, nearly compensating for its 2022 losses.

On a weekly view, META has reached a critical resistance level at Fib 0.786 ($320), which is significant relative to last year’s downtrend. The past three weeks of price action have confirmed this resistance point.

Once there’s a clear weekly close above $320, the next target could be the recent peak at $381. Breaking this peak could potentially drive the share price to the $460 – $560 range in the long term. Conversely, the support area between $270 and $290 is crucial for maintaining the current trend.

Conclusion

Looking ahead, the competition in the field of artificial intelligence will play a vital role in shaping META’s future. Market commentators anticipate an increase in the company’s AI-driven earnings, which could fuel its growth. However, the fact that AI products are largely offered for free poses challenges in generating significant revenue while costs continue to rise.

Additionally, monetizing the Metaverse vision, for which META has invested billions of dollars, remains challenging. The social media platform-weighted advertising revenues need to remain steady to ensure stable growth.

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling or recommendation to invest. We remind you that all assets are evaluated from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor’s own.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link