China stocks rallied and hit a 6-week high, as investor confidence in official stimulus measures strengthened. Property, financial and consumer related stocks in particular benefited, after signals of further support. The BoJ signalled a widening of the band for the 10-year yield, which was taken as a sign that the BoJ is heading for policy normalisation. The Yen rallied as a result. Bunds are selling off in early trade, after much stronger than expected French GDP numbers and as markets continue to digest yesterday’s ECB announcement. French inflation dropped to 5%, the lowest level for 16 months. In US, much stronger than expected GDP, tighter than projected jobless claims, a pop in durable goods orders, a bounce in pending home sales, and a narrowing in the goods trade deficit boosted risk for a 12th rate hike for the FED. Bonds and Stocks selloff.

Overnight: BoJ tweaks yield curve control. The BoJ kept the target for 10-year yields at around 0% but signalled that the 0.5% ceiling was now a reference point, not a rigid upper limit. It will offer to buy bonds at the 1% mark, which means an effective widening of the band. Ueda vowed to keep easing, while at the same time, he pledged to continue to ease tenaciously and to add further easing if necessary. Ueda added that he expects inflation to slow before gradually picking up again.So some attempt to play down the importance of today’s surprise move and prevent markets from buying into an imminent move towards policy normalisation.

- FX – The USDIndex held most of yesterday’s gains and is at 101.72, as the 10-year Treasury yield inched higher. The Yen strengthened with USDJPY at 138 lows. GBP drifted to 1.2760 and EUR at 1.0950.

- Stocks – The CSI 300 is up 2.1%, the Hang Seng still 1.2%, and JPN225 declined. #Evergrande plunged as trading resumed nearly 16 months after the stock was suspended pending the release of financial results. #Ford stock is higher after hours after the automaker reported strong second quarter earnings and also upped its full-year profit forecast, though it did project steeper annual losses in its EV division. Ford’s results come after its crosstown rival #GM reported strong earnings and raised its full-year profit guidance for a second time. #Intel’s (+8% after hours) earnings surprised positively after two consecutive quarters of record losses. Strong sales of drugs for cancer and diabetes helped #AstraZeneca beat sales and earnings expectations.

- Commodities – USOil spiked to $80.30 on tighter supply (Fed raises interest rates by 25 bp, US crude inventories fall less than expected, ECB raises rates to 23-year high, OPEC+ panel meeting in focus)

- Gold – drifted to $1941 from $1980, amid strong US economic data which renewed the Fed’s pledge to stay hawkish.

Today: German Inflation, Canadian GDP and US PCE, Earnings: Exxon Mobil, Procter & Gamble, Chevron etc.

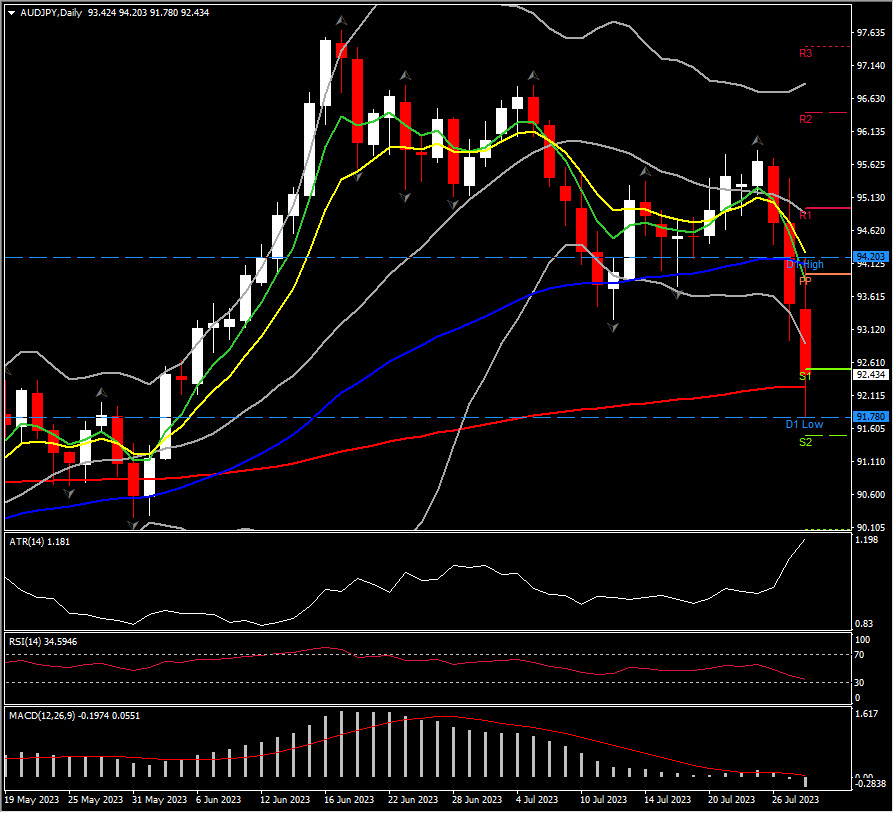

Biggest Mover: (@6:30 GMT) AUDJPY (-1.31%) bottomed at $91.78 with RSI and MACD turning below neutral in line with 3-day sharp decline. ATR(H1) is at 0.591 and ATR(D) is at 1.181.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link