Hewlett Packard Enterprise Co. is a global edge-to-cloud company, actively engaging in the provision of information technology, technology and enterprise products, solutions and services. It operates through various segments namely Compute (general purpose servers for multi-workload computing, workload optimized servers for demanding applications), High Performance Computing & Artificial Intelligence (offers hardware and software solutions to support specific use cases), Storage (provides workload optimized storage product and service offerings), Intelligent Edge (offers wired and wireless local area network, campus and data center switching, software-defined wide-area-network, network security and associated services to enable secure connectivity) and the Financial segment (which provides flexible investment solution and consumption models that support business transformation).

Last week, HPE’s partner Nvidia smashed consensus estimates, with revenue and EPS up 101% and 854% from the prior year period, mainly contributed by its outstanding performance in the data center segment. The company’s share price soared to a record high $496.20 following the announcement (now back to $459.80). Could HPE deliver the same good news for investors just like Nvidia? We shall have to wait and see in its Q3 2023 earnings result, scheduled to be released on 29th August (Tuesday), after market close.

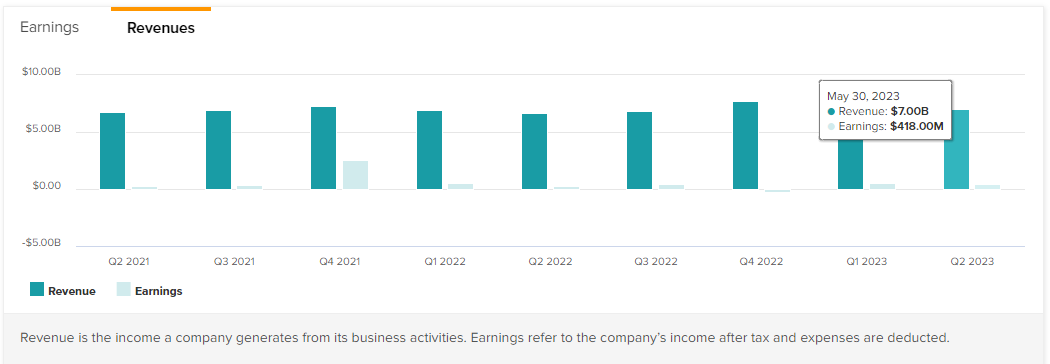

HPE: Revenues & Earnings (After Deduction of Tax and Expenses). Source: Tipranks

In the previous quarter, HPE reported $7.0B in sales revenue, which missed analysts’ forecast and its own estimate ($7.1B to $7.5B). By segment, Intelligent Edge generated the most revenue at $1.3B, up 50% (y/y); High Performance Computing & AI and Financial services were up 18% (y/y) and 4% (y/y) respectively, to $840 million and $858 million. These gains were partially offset by the Compute and Storage segments that underperformed, down -8% (y/y) and -3% (y/y) respectively to $2.8B and $1.0B. Gross profit margin hit 36.2%, up 2% from prior year period; after taking out operating expenses and overhead, the company earned 11.5% in operating profit margin, up 2.2% from the prior year period.

HPE: Reported Sales versus Analyst Forecast. Source: CNN Business

HPE: Reported Sales versus Analyst Forecast. Source: CNN Business

In the coming announcement, consensus estimates for sales revenue of HPE remain flat at $7.0B, within the range of the company’s outlook ($6.7B to $7.2B).

HPE: Reported EPS versus Analyst Forecast. Source: CNN Business

HPE: Reported EPS versus Analyst Forecast. Source: CNN Business

EPS is expected to hit $0.47, down -9.6% from the previous quarter. In the same period last year, the company’s EPS was $0.48.

Last Friday, Fed Chair Jerome Powell reiterated his hawkish stance whereby higher rates may be required to ease the still-high price pressure. There is still some work to be done, and the market has now priced in the terminal rate at a 5.5%-5.75% range, a quarter-point higher than the current range – more pressure for the stock market in the near term?

Technical Analysis:

The #HewlettPackard share price has experienced a technical correction since its failure to break resistance at $17.70, shortly after leaving a new high since March 2018, at $18.12. The asset is currently testing support zone $16.45-$16.95. A break below the zone may further support the correction move towards the next support at $15.50, and the dynamic support 100-week SMA. Otherwise, if the bulls gain control and break above $17.70 and $18.12, the next resistance that is projected by Fibonacci Expansion lies at $19.00, followed by $20.45.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link