The miners’ stocks have fallen deeply out of favour a few weeks into their usual summer doldrums. Even contrarian traders have mostly lost interest in this high-potential sector. Their apathy is causing gold-stock prices to languish, creating the best seasonal buying opportunity of the year. Buying low before later selling high requires deploying capital when few are willing and when sectors are unpopular.

With gold stocks really unloved these days, they are mostly forgotten. The hottest most-favoured stocks are the artificial intelligence market darlings, led by mighty high-performance-chip manufacturer NVIDIA (NASDAQ:). I’ve been a big fan of its awesome graphics cards for decades, which have revolutionized gaming. My kids and I enjoy some of our spare time gaming together on several computers powered by great NVIDIA GPUs.

The incredible computational power necessary for rendering complex high-resolution graphics at high frame rates is also ideal for artificial intelligence applications. That has helped catapult NVDA stock a staggering 290.2% higher in just 10.7 months. Was it more prudent to buy this stock near $112 in mid-October when it was out of favour, or today near $438 trading at 224x trailing-twelve-month earnings?

I’d sure rather buy a stock before it quadruples than after. Once a sector like AI soars high enough for long enough that everyone loves it, the vast majority of its gains are already won. Chasing high fliers’ upside momentum is a very-risky game, as they can collapse anytime. Between late November 2021 to mid-October 2022, NVDA stock cratered a gut-wrenching 66.4%. Buying high often leads to selling low.

While gold stocks will never be anywhere near as popular as mega-cap-tech stocks, they are deeply out of favour now similar to NVIDIA last autumn. That’s rather ironic considering they’ve been no slouches on the performance front. Between late September to mid-April, the leading GDX (NYSE:) gold-stock benchmark powered 63.9% higher on a parallel 25.7% gold upleg. The index merely climbed 13.4% in that span.

The major gold stocks dominating that GDX ETF have certainly weakened since, down 16.2% as of mid-week. They are ultimately leveraged plays on gold, and its own strong upleg had a healthy 5.2% pullback in that timeframe. The big-swing market trends like uplegs never unfold in nice straight lines, they take two steps forward then suffer one step back. Those countertrend selloffs are essential to rebalance sentiment.

Traders’ collective feelings about any stocks are directly driven by their recent performances. NVIDIA has rocketed parabolic over the past month or so, fueling extreme greed. Traders have stampeded into it to chase its scorching upside momentum. But too much buying too fast soon burns itself out, attracting in all the available capital willing to pour into any stock. Once that is exhausted, the euphoric stock price quickly collapses.

NVDA’s overboughtness has exploded to crazy-extreme levels, it was trading at an unbelievable 2.05x its 200-day moving average mid-week. We start ratcheting up our trailing-stop-loss percentages in volatile gold stocks to prepare for selloffs when GDX merely exceeds 1.35x its 200dma. In mid-April at that latest gold-stock upleg high, that overboughtness metric stayed under 1.30x. And that has all been bled off since.

This Tuesday GDX plunged in a big 4.0% down day after a shocking upside surprise in US housing-starts data hit gold. Since that unbelievable eleven-standard-deviation beat had Fed-hawkish implications, gold futures were dumped by speculators. That pounded GDX back down to under 1.03x its 200dma, which was the least overbought gold stocks as a sector have been since mid-March when they were last out of favor.

That naturally turned out to be a good buying opportunity, as GDX shot about a third higher over the next month or so. The current major seasonal lows in gold stocks are looking like another good one. So we are starting to refill our newsletter trading books after some of our trades were stopped out with some solid-to-great gains in recent weeks. Gold stocks’ typical summer-doldrums seasonal lull should be passing.

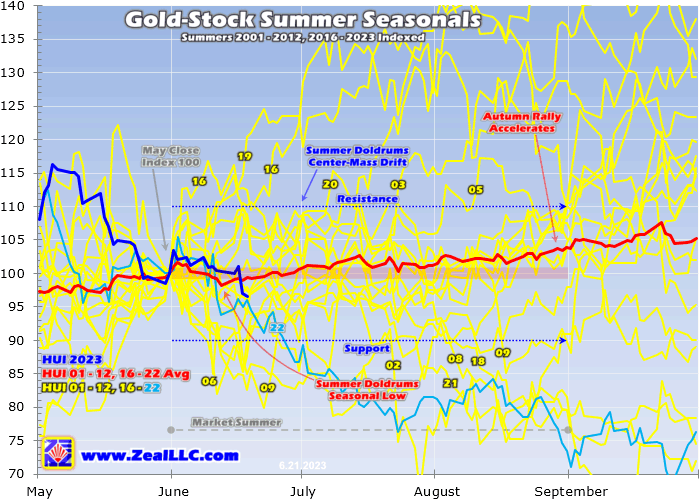

This chart is updated from my latest gold and gold-stocks summer-seasonality-research essay from a couple weeks ago. It reveals how the major gold stocks performed in perfectly-comparable indexed terms in all modern gold-bull-year summers including 2001 to 2012 and 2016 to 2023. Because GDX isn’t old enough for this multi-decade seasonality, the classic gold-stock index which is very similar is used instead.

While most traders have forgotten about gold stocks with the AI bubble led by NVIDIA overpowering most of the market mindshare, some contrarians are still paying attention. And they seem fairly depressed as GDX’s latest pullback lingers on. But there’s nothing unusual about the major gold stocks’ behavior so far in June, their peak-summer-doldrums month. The red line is the indexed seasonal average before 2023.

The apathy and bearishness plaguing gold stocks today are blinding traders to this good seasonal buying opportunity. On average in these modern-gold-bull-year summers, the major gold stocks bottomed down 1.8% in mid-June. Mid-week at their new pullback low, GDX was only down a similar 2.8% summer-to-date. That’s right in line with precedent, and certainly nowhere near bearish enough for traders to ostrich over.

And interestingly the major gold stocks spent most of June tracking above their seasonal average, doing better than usual. It wasn’t until this week’s plunge that they fell modestly below. The HUI’s and GDX’s general summer trading range runs between 90% to 110% of May’s final close. Even after Tuesday’s big plunge, that metric still clocked in at 96.5%. So the recent gold-stock selling is typical summer-doldrums stuff.

Market summers are June, July, and August proper, the vacation season with kids out of school so traders can travel and disengage from markets. That’s a key driver of the apathy this time of year fueling gold’s summer doldrums. During these three months from 2001 to 2012 and 2016 to 2022, the major gold stocks averaged 0.6%, 0.7%, and nice 2.7% gains. The summer doldrums are actually more the June doldrums.

Gold stocks typically bottom in mid-June, then grind sideways-to-higher into mid-July. Then gold’s powerful autumn rally starts gathering steam, accelerating gold-stock upside in August. There’s no reason not to expect this long-established seasonal pattern to persist in coming months. On the contrary, gold stocks have much better upside potential than usual this summer. They could easily surge to outsized gains.

Leveraging gold’s own upleg resuming is the main reason. Major gold uplegs are driven higher by three sequential stages of progressively-larger buying building on each other. Stage one is gold-futures short covering, which is followed by stage-two gold-futures long buying, then ultimately stage-three investment buying. While this upleg’s initial short covering remains exhausted, speculators have vast room to add longs.

I analyzed this in depth in another essay last week on gold bottoming despite the Fed. On average over the past year, total spec longs outnumbered shorts by 2.3x making them proportionally more important. Today’s strong gold upleg has powered an impressive 26.3% higher at best so far in 7.2 months. It was born in late September when spec longs only ran 247.5k contracts. They’ve now retreated back to just 276.3k.

In recent years the upper resistance zone of spec longs where gold uplegs topped and rolled over into corrections ran near 413k contracts. The trading range between there and this upleg’s birth is a massive 165.5k. But thanks to gold’s recent pullback driven by gold-futures selling, total spec longs are now just 17% up into that trading range. That implies these traders have fully 5/6ths of their stage-two long buying left.

That equates to enormous gold-equivalent buying potential of 425.3 metric tons. And the much-bigger and more-important stage-three investment buying has only just started. The best high-resolution proxy for global gold investment demand is the combined holdings of the globally-dominant American GLD (NYSE:) and IAU gold ETFs. They’ve barely budged so far during gold’s current upleg lifespan since late September.

At best between mid-March to late May, these holdings have merely climbed 4.3% or 58.2t. Investors have remained missing in action, partially because they’ve been distracted by this extreme AI bubble NVIDIA’s stock is leading. Gold’s last two major uplegs comparable to today’s both crested in 2020, at huge 42.7% and 40.0% gains. Big investment buying fueling them drove GLD+IAU holdings dramatically higher.

They soared a massive 30.4% or 314.2t during the first, then an even-larger 35.3% or 460.5t in the second. So at best only about 1/6th of this gold upleg’s potential stage-three investment buying has happened yet. There’s a good chance investors will return during gold’s coming autumn rally, as they love chasing upside momentum. Their buying will amplify gains initially fueled by gold-futures speculators re-adding longs.

Despite this raging inflation unleashed by the Fed more than doubling the US monetary base after March 2020’s pandemic-lockdown stock panic, gold’s performance has lagged over this past year. The primary reason was the Fed’s ultra-hawkish extreme rate-hike cycle, an incredible 500 basis points in just 13.6 months. But with top Fed officials forecasting maybe another 50bp at most, that hiking cycle is mostly over.

With the Fed running out of room to keep hiking, hawkish Fedspeak will wane. That will further weaken the , motivating speculators to return to gold futures. The major gold stocks of GDX tend to amplify material gold gains by 2x to 3x. To achieve another 40% upleg off late-September’s deep stock-panic-grade low, gold would have to power up near $2,275. That’s another 18% higher from this week’s low.

That could easily drive additional major-gold-stock gains exceeding 50% from here, which is well worth fighting the herd to buy these seasonal lows. And the smaller fundamentally-superior mid-tier and junior gold miners we’ve long specialized in should fare much better. Those are the trades we are starting to reload in our newsletters, getting fully deployed for this sector’s next surge likely during coming months.

Gold’s potential upside could be boosted whenever this AI stock bubble pops, dragging euphoric stock markets sharply lower. Then investors will remember the timeless wisdom of prudently diversifying their mega-cap-tech-heavy stock portfolios. Gold stocks’ coming upside should be accelerated by what are likely to prove excellent Q2’23 operational and financial results they will report from mid-July to mid-August.

Gold-mining earnings are generally the difference between prevailing gold prices and the all-in sustaining costs for producing that gold. In Q2’22, gold averaged $1,872 on close. So far in this almost-finished Q2’23, gold has averaged a record $1,986 despite its latest pullback. With average gold prices surging a hefty 6.1% year-over-year, gold-mining revenues should climb accordingly. That alone will really boost profits.

But the major gold miners dominating GDX are also largely forecasting higher outputs and lower costs as 2023 marches on. I analyzed this in my recent essay on the Q1’23 results reported by GDX’s 25 largest component stocks. In Q2’22 their average AISCs ran $1,281 per ounce. Based on their 2023 guidances, it wouldn’t surprise me if they retreat 5% YoY this quarter. But let’s be conservative and assume just 3%.

That would yield major-gold-miner AISCs around $1,243. Subtract that from $1,986 average gold prices and sector profits are tracking near $743 per ounce. That would make for excellent 26% YoY unit profits growth, really ramping bottom-line earnings and leaving gold-stock valuations even cheaper. Plenty of great gold miners are trading at sub-20 TTM P/E ratios, an order of magnitude cheaper than NVIDIA’s 224x.

So it sure looks like the largely-forgotten gold stocks have drifted down to a good seasonal-low buying opportunity. Between gold’s usual summer-doldrums apathy and the distractions of this latest AI stock-market bubble, most traders aren’t paying attention. So like NVIDIA back in October at just a quarter of its current levels, they’ll miss buying now-unpopular gold stocks at prices way under where they are heading.

Buying low before later selling high requires deploying capital in unpopular sectors when we really don’t want to. The more out of favor any sector, the worse it feels to buy in, the greater the odds it is in the process of bottoming soon before a major rally. Gold stocks certainly look that way today. Contrarians with the experience and mental toughness to fight the bearish herd and deploy capital should be richly rewarded.

The bottom line is gold stocks are looking like a good seasonal buy. After suffering a pullback with gold since early May, they are really out of favor today. Apathy and bearishness abound in this peak-summer-doldrums month, despite gold-stock prices tracking June seasonal norms. These latest strong gold and gold-stock uplegs are likely to resume with a vengeance in coming months, powering up to big new gains.

The gold stocks will leverage gold like usual, which has massive gold-futures long buying and investment buying remaining. The Fed running out of room to keep hiking rates should ignite the former, which will drive gold high enough for long enough to entice investors to return. The gold miners’ fundamentals are also really improving with higher prevailing gold prices and lower costs, helping make for a very-bullish setup.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link