Intel Corporation (INTC) is a leading American technology company and a leading manufacturer of semiconductor chips. Intel, founded in 1968, is known for its central processing units (CPUs) that power various computing devices. The company has a market capitalisation of $140.27B.

Intel plans to report earnings for its fiscal second quarter ending June 2023 on Thursday, July 27 after the market closes.

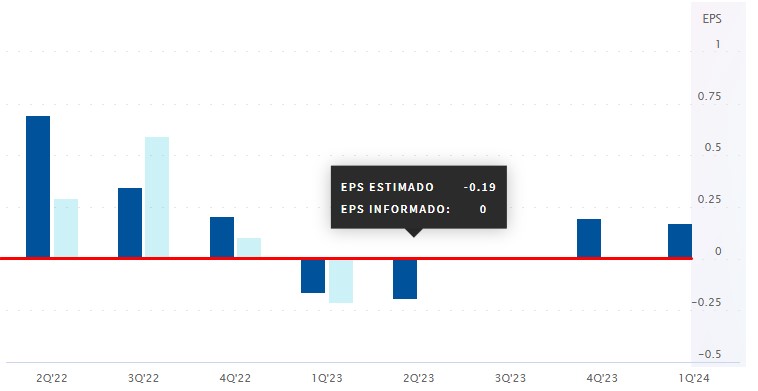

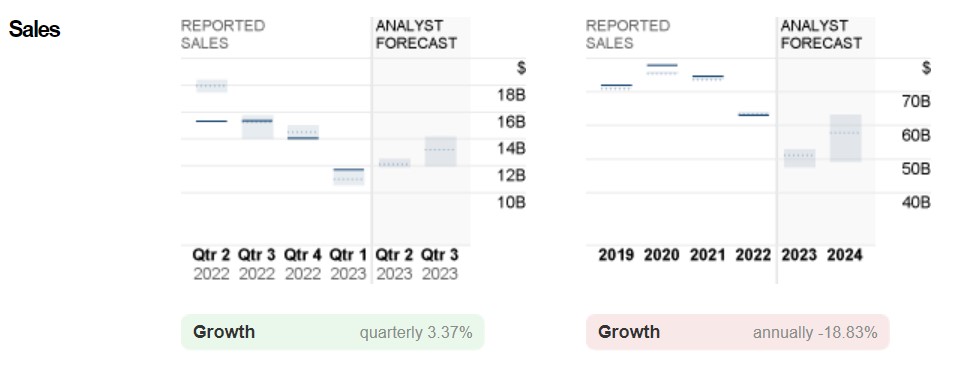

Zacks ranks Intel “Rank #2 – Buy” in the Top 33% at #82/251 in the Semiconductors industry. For this report, EPS is expected at $-0.03 ($0.19 for Nasdaq) with an ESP of 19.64%, marking a -113.79% year-over-year drop from $0.29. A profit of $12.03B is expected, which would be a drop of -21.51% year-over-year from $15.32B.

The estimate has had no downward revisions and 3 upward revisions in the last 60 days. Intel has a P/E ratio of 78.21 and a PEG ratio of 14.99. The company has reported mixed results for the last 4 quarters.

Last quarter the company reported EPS of -$0.21 and revenue of $11.7B.

Regarding Intel’s share price forecast for the next 12 months, the lowest forecast is down -50.1% at $17.00, and the highest expectation up +90.7% at $65.00, while the average price is down -6.1% at $32.00.

Elements to consider

In the second quarter, Intel collaborated with several companies which could put a positive reflection on these results.

First with Hewlett Packard Enterprise and the Department of Energy to install the “Aurora” supercomputer at Argonne National Laboratory ensuring extremely fast operations with its high performance “HPE Slingshot” framework.

There was another collaboration with Ericsson to accelerate the development of 5G infrastructure in Thailand supporting sectors such as manufacturing, transportation and logistics supporting Intel’s top line. This strategic collaboration will utilise Intel’s 18A process (which is the most advanced node on the roadmap of five nodes in four years available by 2025) and Intel’s manufacturing technology in Ericsson’s future optimised next-generation 5G infrastructure.

As our work together evolves, this is a significant milestone with Ericsson to partner extensively on its optimised next-generation 5G infrastructure. This agreement exemplifies our shared vision to innovate and transform network connectivity, and reinforces customers’ growing confidence in our manufacturing process and technology” – Sachin Katti, senior vice president and general manager of Intel’s Network and Edge group.

As part of the agreement, Intel will manufacture custom 5G SoCs for Ericsson to create highly differentiated products. In addition, they will extend their collaboration to optimise 4th gen Intel Xeon processors with Intel vRAN Boost for Ericsson’s Cloud RAN solutions. The two companies will work together to accelerate their adoption on an industrial scale.

Ericsson has a long history of close collaboration with Intel, and we are pleased to expand this further as we use Intel to manufacture our future custom 5G SoCs on its 18A process node, which is in line with Ericsson’s long-term strategy for a more resilient and sustainable supply chain” – Fredrik Jejdling, executive vice president and head of Networks at Ericsson.

After Intel 20A introduces the new integrated gate transistor architecture known as RibbonFET and backside power delivery known as PowerVia, Intel will introduce ribbon architecture innovation and increased performance along with a reduction in continuous metal line width at 18A. By combining their efforts, these technologies will elevate the next products Intel’s customers will bring to market and return Intel to process leadership by 2025.

It also teamed up with Boston Consulting Group to develop reliable, enterprise-grade generative AI solutions to help optimise operations, using Intel’s AI supercomputer and a domain-specific base model trained by BCG. This is an attempt to gain a foothold in the new era of artificial intelligence, which compared to AMD and NVIDIA, Intel will be more subdued.

In addition, it delivered prototype multi-chip packages to support the US Department of Defense’s mission to modernise and enhance the capability of the defence industrial base for equipment development and deployment.

Intel has announced a change in its processor branding to simplify names and meet customer requests starting with the new generation of “Meteor Lake” processors. High-end processors will now include “Ultra” in their branding, such as “Intel Core Ultra 9”. Generational information will continue to be added to the end of the name. Intel has yet to announce a release date or specific details.

It is possible that the strength in the data centre business from the first quarter will continue into this quarter and may offset weakness in the PC end-markets business subdued by low demand along with SMB and consumers in general affecting Intel’s top-line figures.

To expand its presence in Europe, Intel launched several investment projects. The company and the German federal government signed an agreement for the company to invest more than €30 billion to expand its next semiconductor manufacturing plant in the European nation. In addition, it said it would build a state-of-the-art semiconductor assembly and test facility near Wroclaw, Poland, to meet growing demand for sophisticated semiconductor solutions.

On the other hand, blockades put on chips are a serious and worrisome problem that may expand due to the growing geopolitical tension between the US and China. In addition, market volatility, inventory adjustments, the falling dollar affecting the exchange rate and macroeconomic challenges continue to affect Intel’s net sales.

Technical Analysis – Intel D1 – $34.05

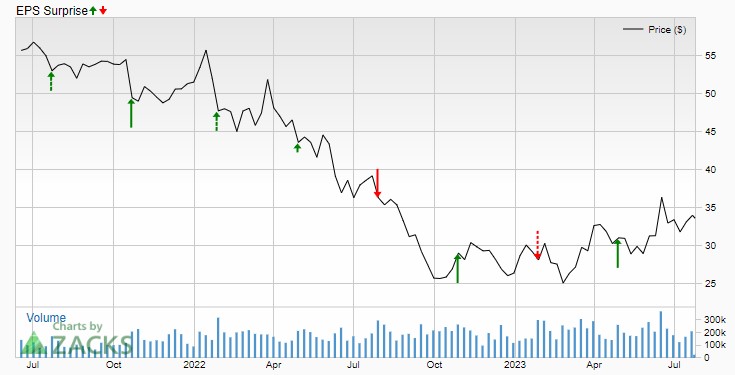

Intel saw a 64.10% drop from its 2021 highs at $68.47. In the first quarter Intel rose 36.84% from its lows at $24.68 (very close to the 2022 lows at $24.55 to the end of the quarter at $32.56.)

This second quarter the price retraced 76% from a low of $26.80 to give a second boost of 38.19% to the highs of the quarter at $36.93. In this quarter and with the new momentum, the price managed to break the bearish trend line that had been in place since the highs of April 2021. Then, by the end of the quarter and the beginning of the new quarter, the price retraced to the broken downtrend line, the 50-period daily SMA and the 50% Fibo at $31.87, currently holding above the 20-period daily SMA at $33.43 and the psychological level of $35.00 awaiting its earnings results.

In the event that Intel comes out positive on its earnings we could see a bullish distribution breaking the second quarter highs and looking for the July highs of last year above the psychological $40.00 level at $40.67 and close to the 38.2% Fibo at $41.33. Conversely, if the outcome is negative, Intel’s price could look for the first or second quarter lows below the psychological $30.00 level.

The ADX is at 16.37 with the +DI at 20.71 and the -DI at 18.56, with no trend confirmation yet. RSI is at 54.49, hovering around the 50 zone since June 21. 100 period SMA W1 at $38.31

Click here to access our Economic Calendar

Aldo W. Zapien

Market Analyst – South American Office

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link