- According to Warren Buffett’s preferred indicator, stocks are currently overvalued

- Above 100% indicates overvaluation, and it is at now 170%

- What does that imply for the market in the long-run?

Warren Buffett is issuing a cautionary note: stocks appear to be entering a phase of overvaluation, as indicated by his preferred measure.

Back in 2001, in an article featured in Fortune magazine, Buffett firmly asserted that this particular metric holds the potential to be the most precise barometer of market valuations at any given juncture.

Buffett introduced this indicator nearly two decades ago, underscoring the significance of the ratio between the stock market’s overall capitalization and the nation’s gross domestic product (GDP) as the ultimate litmus test for gauging whether the market leans towards the costly or economical, overvalued or undervalued.

Put simply, it contrasts the aggregate market capitalization of publicly traded stocks against the most recent quarterly data on the United States’ gross domestic product.

When this measure eclipses the 100% threshold, it raises a flag indicating that stocks are entering the realm of overvaluation. At present, this very indicator has surged notably, reaching an elevated level of 170%.

However, it’s important to note that while this indicator is valuable, it’s not foolproof, primarily for two reasons:

- It bases its assessment on the comparison between the previous quarter’s GDP and the current stock market value.

- The GDP doesn’t account for foreign earnings, even though U.S. companies do include their international operations.

Link Between Earnings per Share and Stock Market Performance

Despite companies surpassing quarterly earnings projections, a curious trend has emerged – the usual harmony between earnings and stock market movement seems disrupted.

A comprehensive analysis conducted by FactSet unveils that an impressive 79% of S&P 500 companies have outperformed earnings forecasts. While this statistic outshines the 10-year average, the reaction from the stock market has taken an unexpected turn.

Surprisingly, stocks that managed to surpass earnings per share (EPS) estimates experienced a decline of -0.5% on average in the subsequent trading session. This contrasts starkly with the norm over the past five years, where such stocks typically enjoyed an ascent of +1%.

Investor sentiment (AAII)

- Bullish sentiment, i.e., expectations that stocks will rise over the next six months, declined 4.3 percentage points to 44.7% but remains above its historical average of 37.5%. This was the longest above-average streak since a 13-week period from February through May 2021.

- Bearish sentiment, i.e., expectations that stock prices will fall over the next six months, is at 25.5% and remains below its historical average of 31%.

The mBridge Project Poses a Challenge to the U.S. Dollar?

The digital yuan’s push to challenge the supremacy of the is gaining momentum through the dynamic mBridge project, a novel platform geared toward expanding the influence of China’s digital currency.

This digital-backed prototype, designed for facilitating global money transfers without depending on U.S. financial institutions, is advancing at a rapid pace. So much so, that certain observers in Europe and the U.S. now view it as a nascent contender against dollar-dominated transactions in the global financial landscape.

The collaborative mBridge initiative, involving China, Thailand, Hong Kong, and the United Arab Emirates, has the potential to streamline the circumvention of sanctions, taxes, and anti-money laundering regulations.

While the project gains traction, the International Monetary Fund (IMF) is aiming to avert its evolution from a technical solution into a geopolitical instrument.

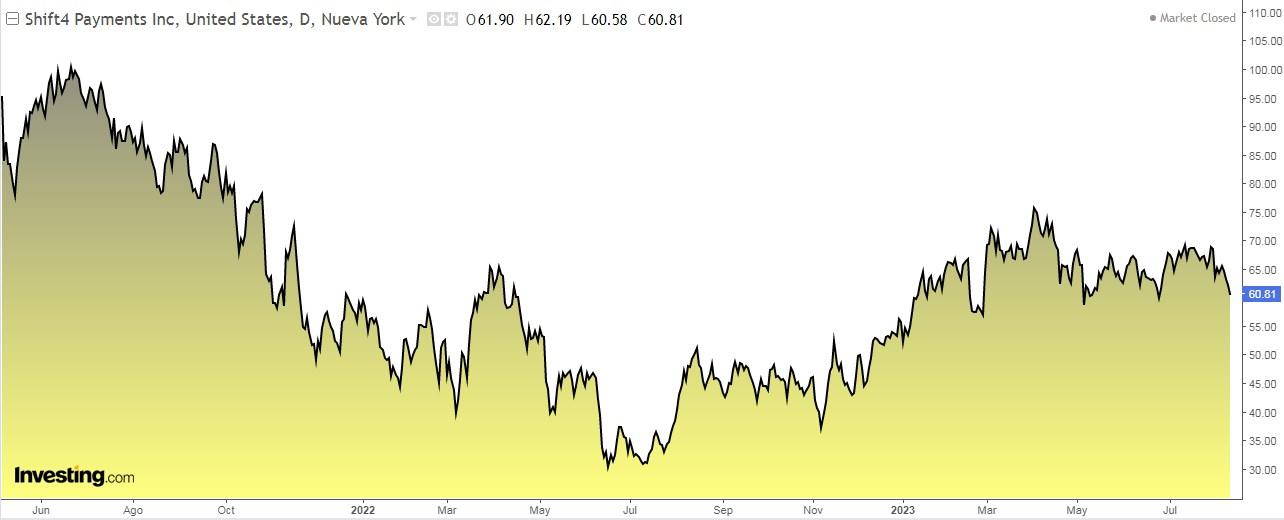

Shift4 Payments: Worth a Buy?

Shift4 Payments (NYSE:) is a US-based payment processing company that was established in 1999 and is headquartered in Allentown, Pennsylvania.

Here’s why you should keep a close watch on it:

- Strong Quarterly Performance: The company’s recent quarterly , unveiled on August 3, were highly promising. Impressively, earnings per share exceeded market expectations by a remarkable +36%, alongside a similar beat in revenues.

- Upcoming Results on the Horizon: Mark your calendar for November 7th, as the company is poised to release its next set of results. Expectations are high for another positive showing, both in terms of revenues and earnings per share.

- Positive Outlook for Earnings and Revenue: The company’s earnings per share and revenue projections for 2023 and 2024 are looking optimistic.

- Market Potential: Analysts see potential in the company, estimating a value between $80 and $83.

- Near Support Levels: The company is currently hovering near its two critical support levels at $58.81 and $56.31 and could bounce off them.

US Treasury Holds Key Stake in Now-Bankrupt Yellow

Yellow, the trucking company, took the step of filing for bankruptcy on August 6th. However, a lesser-known aspect is the breakdown of its shareholding and the prominent figures who hold the company’s shares.

It might come as a surprise that the U.S. Treasury is positioned as the second largest shareholder.

Here’s the notable lineup:

- MFN Partners Management: Leading the podium with a substantial 42.5% ownership.

- U.S. Treasury: Claiming the second spot with a sizable 30.6% ownership.

- Vanguard: Holding a noteworthy 5.1% ownership stake.

***

Disclosure: The author doesn’t hold any of the securities mentioned.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor’s own.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link