On Tuesday, is trading in the area around 1,960, recovering from the previous week’s drop to 1,940.

The decline was triggered by the strong preliminary GDP data for the second quarter of this year in the US, which showed a growth rate of 2.4%, exceeding experts’ expectations of 1.8%. As a result of the data release, the dollar gained significant support, leading to its strengthening against major currencies and causing gold to retreat from its daily highs near 1,980 to the area of 1,940.

Despite the appreciation, gold remains in demand as a safe-haven asset amid ongoing geopolitical instability. On Friday, data on the US labor market (Nonfarm Payrolls, Unemployment Rate) will be released, which could provide new momentum for gold prices.

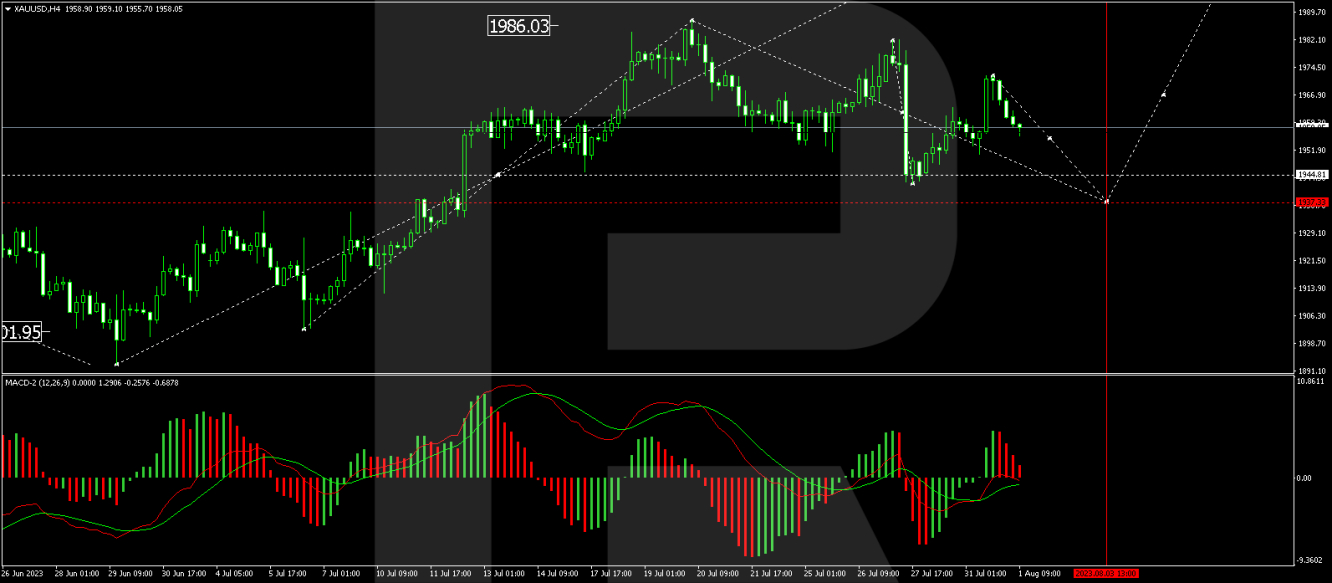

XAU/USD technical analysis

On the H4 chart of , the upward wave towards the level of 1986.00 has been completed. Currently, we are considering the development of a correction. Its structure suggests a 1937.33 target. Once this correction is completed, we expect the price to rise towards 1995.55. This scenario is technically supported by the MACD indicator, as its signal line is below the zero mark and is pointing downwards.

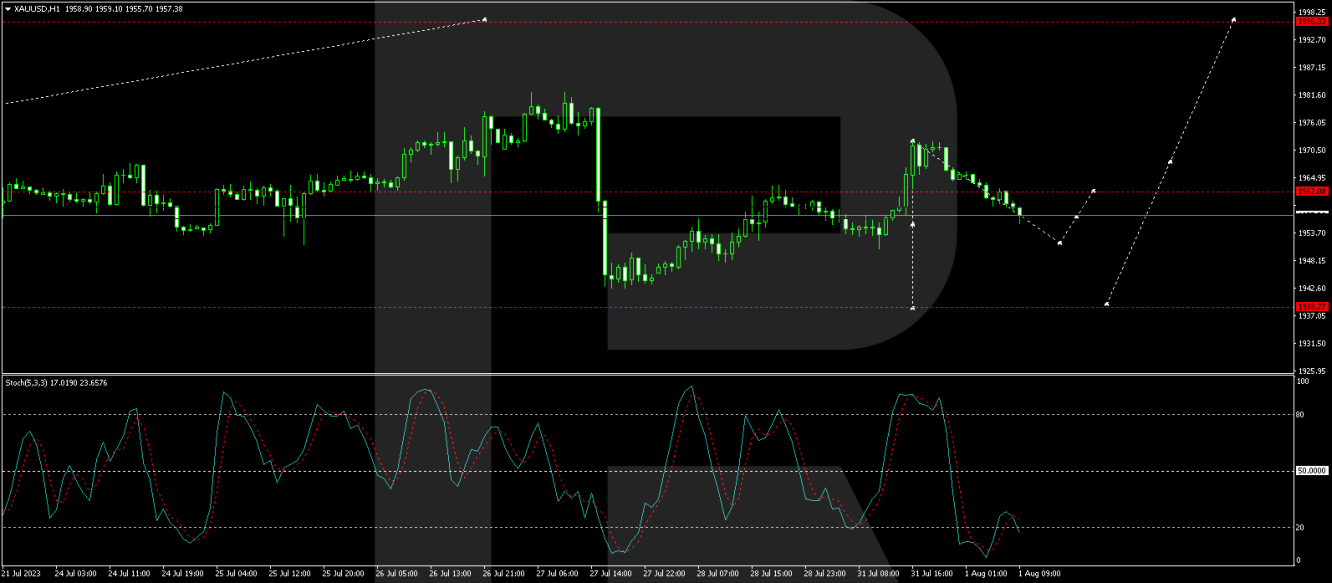

On the H1 chart of XAU/USD, the downward wave towards the level of 1942.65 has been completed. The target is local. After its completion, a structure for upward movement towards the level of 1962.00 has formed. We expect a decline to 1949.44 before evaluating the formation of a consolidation range. If there is a breakout below this range, a decline to 1938.77 is expected. On the other hand, a breakout above the range would signal the potential for an upward wave towards the level of 1972.60. The Stochastic oscillator supports this scenario, with its signal line below the 20 mark and pointing downwards.

Disclaimer: Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link