- Earnings season continues, with healthcare companies set to report next week

- Among them is Pfizer, whose stock has corrected significantly of late

- Based on the company’s strong fundamentals, is the dip a buying opportunity?

Earnings season is in full swing, and next week, we’ve got our sights set on the healthcare sector, specifically pharmaceutical and biotechnology companies, as they get ready to reveal their quarterly results.

So, let’s jump right into the analysis and find out which of these companies hold the most promising buying opportunities at their current price levels.

To make this assessment, we’re counting on the InvestingPro fundamental analysis tool. We have compiled an InvestingPro watchlist that highlights key pharmaceutical and biotechnology stocks scheduled to release their Q2 results next week.

Earnings Imminent for Several Healthcare Stocks but Pfizer Stands Out

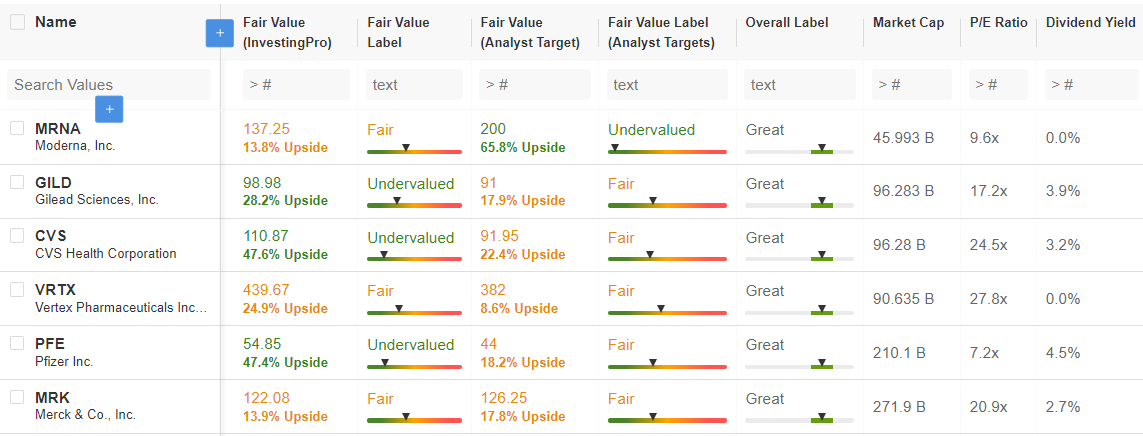

Moderna (NASDAQ:), Gilead (NASDAQ:), CVS Health (NYSE:), Vertex (NASDAQ:), Pfizer (NYSE:) and Merck & Company (NYSE:) feature on our watchlist.

Source: InvestingPro, Watchlist screen

According to the watchlist, all the stocks on the list show a ‘very good’ overall financial health score.

When it comes to analyst opinions, it’s important to note that, except for Moderna, all the stocks on this list are considered fairly valued with limited upside potential. Analysts predict Moderna’s growth at an impressive 65.8% over the next 12 months.

InvestingPro’s Fair Value metric, which combines various recognized financial models, projects over 47% upside potential for CVS Health and Pfizer and 28% for Gilead, indicating that these stocks are undervalued. On the other hand, InvestingPro models label Moderna, Vertex, and Merck as fairly valued.

We also looked at their Price-to-Earnings Ratio (PER) to further differentiate these healthcare stocks. Pfizer stands out with the lowest PER of 7.2, while Vertex tops the list with a PER of nearly 28, making it the most expensive. For comparison, the average PER for pharmaceutical stocks similar to Pfizer is 14.2.

Lastly, considering dividends, a critical metric for long-term investments, Pfizer takes the lead, offering an annual yield of 4.5%.

In conclusion, based on InvestingPro models, dividend yield, and PER, Pfizer emerges as the most promising healthcare stock on this list from a fundamental analysis perspective.

Pfizer: A Buying Opportunity in the Wake of Excessive Correction

Despite its shining performance during the pandemic with COVID-19 vaccine sales, Pfizer’s stock underwent a correction throughout 2022, and the losses intensified at the beginning of this year.

The stock price plummeted from a historical high of $61.71 in December 2021 to a recent low of $35.38 (a decline of over 20% since the start of the year), a level last seen before the pandemic began. This suggests that the market correction might have been excessive, potentially presenting a buying opportunity.

Moreover, there are good reasons to believe that Pfizer’s sales will rebound from the inevitable post-pandemic dip.

Strong Product Pipeline Should Help Sales Rebound in the Medium-To-Long Term

Moreover, there are good reasons to believe that Pfizer’s sales will rebound after an inevitable post-pandemic dip. The company’s CEO, Albert Bourla, stated in January that Pfizer is entering the most crucial phase in its history.

The company plans to obtain an impressive 19 new market authorizations by next year, compared to its usual rate of launching one or two new products per year.

While Pfizer’s sales declined by 29% in the first quarter compared to the previous year, excluding COVID-19-related products, other sales increased by 5%.

Pfizer Is Also a Solid Dividend Stock

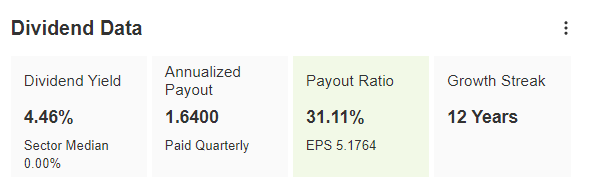

In addition to the potential sales rebound and seemingly low price, Pfizer is an attractive dividend investment. Its dividend yield of 4.46% is more than double the average. Furthermore, Pfizer has a history of increasing its dividends, with payments rising by nearly 70% over the past decade.

Dividend Data

Source: InvestingPro, Dividend screen

According to InvestingPro data, Pfizer has increased its dividend for the past 12 years. Additionally, the company’s payout ratio is currently only 31.11%, indicating ample opportunity for future dividend increases.

What to Expect From Pfizer’s Q2 2023 Results Next Week?

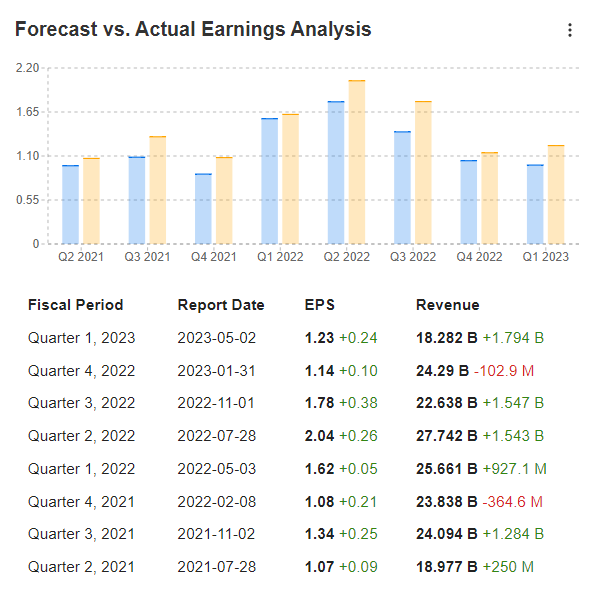

Pfizer will report its Q2 2023 results next Tuesday, August 1st. The consensus estimates an EPS of $0.59, a forecast lowered by over 60% in the last 90 days. The revenues are expected to be $13.45 billion, representing a significant slowdown compared to the previous quarter.

Upcoming Earnings

Source: InvestingPro, Results screen

However, these low expectations suggest that the bar isn’t too high for a positive surprise. Pfizer’s Q1 significantly exceeded expectations, both in terms of revenue and EPS.

Forecasts Vs. Actual

Source: InvestingPro, Results screen

Finally, Pfizer’s earnings history shows that Pfizer’s EPS has exceeded expectations for the last eight consecutive quarters.

Conclusion

Pfizer stock has faced significant challenges over the past year and a half following its stellar performance during the pandemic. However, it now seems to have been unduly punished by the market, offering a buying opportunity at very attractive price levels.

Additionally, the company’s ambitious pipeline of new drugs, expected to receive market authorizations in 2023, promises to boost revenue growth. Long-term investors will also appreciate Pfizer’s strong and steadily increasing dividend, one of the highest in the sector for over a decade.

Finally, long-term investors will appreciate Pfizer’s solid dividend, which is among the highest in the sector and has been rising steadily for over a decade.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest as such, it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and the associated risk remain with the investor.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link