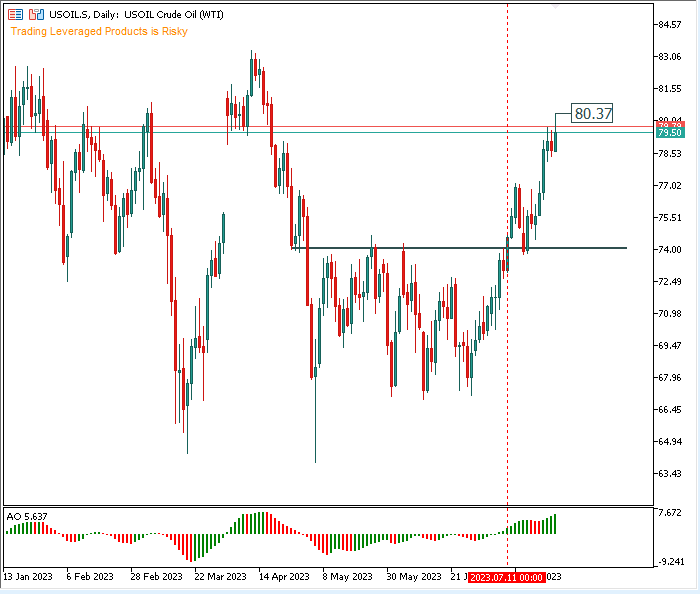

Chevron Corp. is expected to report earnings on Friday (28/07) before market open, amid rising crude oil prices. The report is for the fiscal quarter ending June 2023. USOil prices broke $80/barrel for the first time since mid-April on Thursday (27/07). Analysts expect a drop in profit due to lower energy prices in 2023.

Oil prices rallied amid the prospect of tighter global supply, a downgrade of US recession forecasts and stronger demand in China. Chinese authorities recently pledged to increase stimulus support, strengthening the oil demand outlook for the world’s top crude importer. Earlier, the Energy Information Administration (EIA) reported a drawdown in crude and fuel inventories in the United States, apparently adding to concerns about commodity supply. Meanwhile, Shell recorded a large drop in earnings during the second quarter due to lower production volumes and lower margins in its oil refining business.

Oil prices rallied amid the prospect of tighter global supply, a downgrade of US recession forecasts and stronger demand in China. Chinese authorities recently pledged to increase stimulus support, strengthening the oil demand outlook for the world’s top crude importer. Earlier, the Energy Information Administration (EIA) reported a drawdown in crude and fuel inventories in the United States, apparently adding to concerns about commodity supply. Meanwhile, Shell recorded a large drop in earnings during the second quarter due to lower production volumes and lower margins in its oil refining business.

Energy giant Chevron noted that production in the West Texas Permian Basin hit a quarterly record in its performance highlights for the second quarter. According to Chevron, Permian output is on track to reach its full-year forecast and total production reached 772,000 barrels of oil equivalent per day. Despite the performance, Chevron has produced 2.9 million barrels of oil equivalent per day so far in 2023, maintaining a constant production rate compared to 2022.

Meanwhile, Chevron paid $7.2 billion in dividends and stock purchases to shareholders in the second quarter, totalling $2.8 billion. In addition, the $6.3 billion acquisition of PDC Energy (PDCE) is expected to be completed in August.

Although revenue declined from a year earlier, Chevron beat market expectations in the first quarter. First-quarter earnings increased 6% to $3.55 per share. Sales fell 6% to $50.79 billion. Higher margins on refined product sales drove the earnings hit, partially offset by lower oil prices and rising production costs.

According to Zacks Investment Research, based on 7 analysts’ estimates, the consensus EPS estimate for the quarter is $2.95. The reported EPS for the same quarter last year was $5.82. Ranking the stock at #3 (hold), based on short-term price targets offered by 18 analysts, Chevron’s average price target stands at $188.33. Estimates range from a low of $163.00 to a high of $212.00. The average price target represents a 15.85% increase from the last closing price of $162.56.

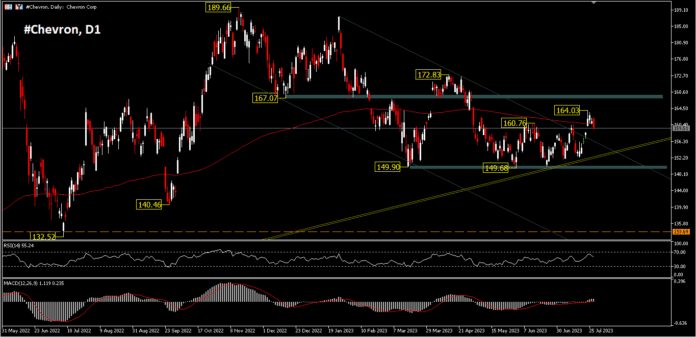

Technical Analysis

#Chevron fell more than -1% on Thursday’s trading (27/7), and traded below the 160.00 round figure. The consolidation that took place in the last 2 months between 149.68-160.76 was successfully broken to the upside by registering a high of 164.03 last Monday. And since then, the price has retreated more than -2.5% to the downside. For now, #Chevron is moving amidst a flat 200-day EMA, due to the accumulated moving average of price consolidation in May-July. Major resistance is still seen at 167.07 as the neckline of the daily double top pattern and the structural support of 149-66/149.90 will hold the bears’ control. A break above this crucial support would confirm a continuation of the decline of the 189.66 peak recorded in November last year and the bear market could move further to 140.46 and 132.52. On the positive side, a move above 167.07 could equalize April’s peak of 172.83, if earnings expectations are exceeded.

The RSI repeatedly failed to reach overbought levels during the consolidation and the MACD temporarily portrays the bulls’ disappointment, after jumping out into the buy zone amid lower earnings expectations.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link