The day before the all-but-done 25 bp Fed rate, Wall Street rallied, Treasuries slumped, and the USDIndex was little changed. Uncertainty over the FOMC’s policy path through the rest of the year limited activity, however, amid position jockeying. Concurrently, Treasury yields edged slightly higher as the market sees increased risk the Fed will tighten further beyond today. China optimism has already faded again and Hang Seng and CSI 300 pared yesterday’s gains. Cautious markets are waiting for the Fed announcement today, while weighing China’s growth outlook.

- FX – The USDIndex finished at 101.285, down from the earlier peak of 101.64. USDJPY at three days lower at 140.50. GBP spiked to 1.2900 rebounding from 20-DMA.

- Stocks –The US100 outperformed, rising 0.61%, while the US500 was up 0.28%, with the US30 up 0.08%. For the latter, it was sufficient for a 12th consecutive gain, just shy of a record 13th. The JPN225 was little changed, the ASX up 0.9% at the close, buoyed by a softer than expected quarterly inflation gauge .

- Commodities – USOil hit a high of $79.73 per barrel. It has not closed with a $79 handle since April 19 and that could prove a difficult a difficult resistance level for now.

- Gold – extended to $1971.

Today: Fed policy outlook: it is Fed week with the FOMC rate decision today. All of the focus will be on the policy statement and Chair Powell’s press conference as a 25 bp hike is a done deal. Implied Fed futures are basically fully priced for that and are suggesting about 30% chance for a subsequent tightening by the end of the November 1 meeting. A cut is being priced in for late Q1 2024. While we concur with the market view that this will be the last of the Fed’s tightening in this cycle, Powell will not sound the all clear. Both he and the policy statement will leave the door open for more action ahead if need be with data dependency stressed. The statement likely will reiterate that the economy continued to expand “at a moderate pace,” that job gains have been “robust,” while unemployment remained “low,” with inflation still “elevated.” Uncertainty over the outlook will also be highlighted. Powell will also reiterate the need to return inflation to the 2% goal and will stress policymakers remain “resolute” in that stance. However, we would not be surprised if that target loosens up way down the road and is in fact not fully achieved. But that will be years in the making and so far in the future that it will not hurt credibility too badly.

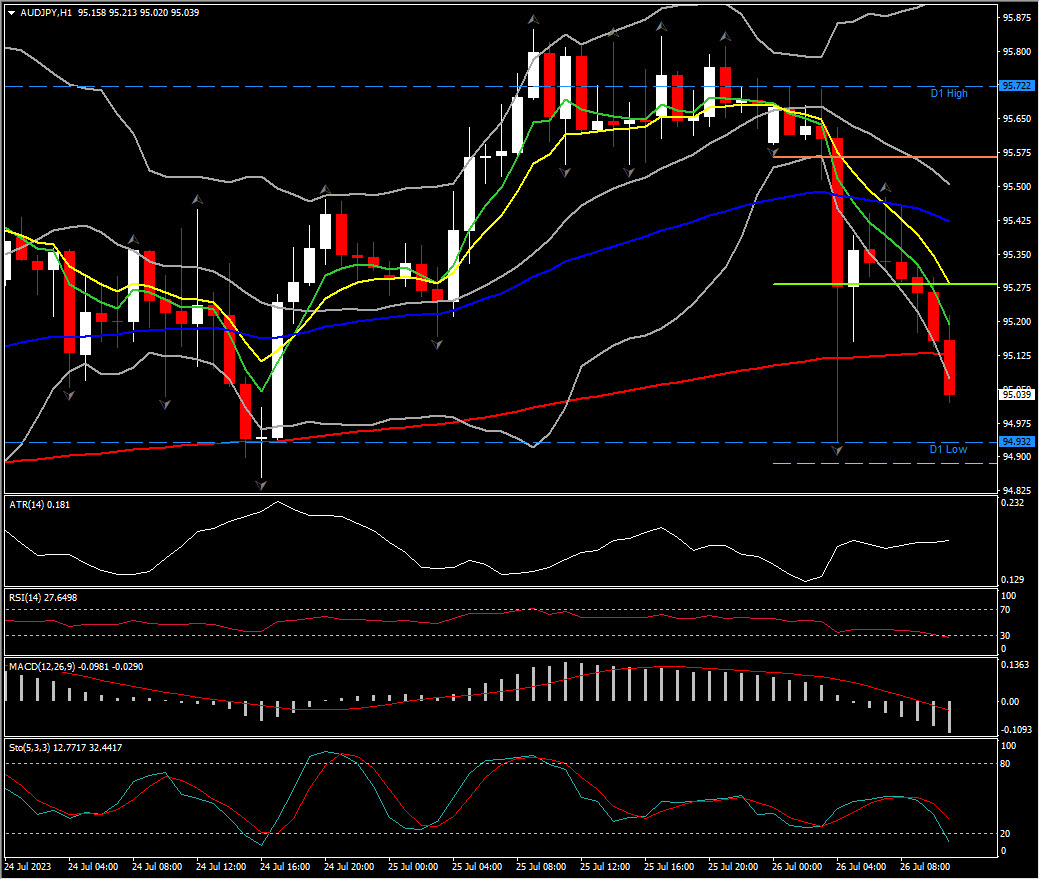

Biggest Mover: (@6:30 GMT) AUDJPY (-0.64%) drifted to $94.93 with RSI at 27, MACD negative, while fast MAs aligned lower.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link