Speech by Philip R. Lane, Member of the Executive Board of the ECB, at the SUERF Marjolin Lecture hosted by the Banca d’Italia

Rome, 18 November 2024

Introduction

My aim today is to explain how macroeconomic models can help in understanding the extraordinary 2021-2022 inflation surges and the monetary policy response, in the context of the euro area.[1] By and large, the scale and persistence of the inflation surge surprised the central banking community, external experts and market participants. The unexpected nature of the inflation surge triggered many questions about the performance of macroeconomic forecasters.

At the same time, macroeconomic models can help us understand why the baseline projections did not foresee the inflation surge in its full scale and speed, while shedding light on the possible mechanisms and channels that may have been missed or under-stated. Scenario analysis has been enhanced and new models have been developed to enrich our understanding of the shocks that hit the economy over this period, as well as the mechanisms through which these shocks were transmitted to inflation. Models also play a central role in constructing some of the measures of underlying inflation that the Governing Council uses as an important cross-check for the inflation outlook. And models are essential in constructing policy counterfactuals to assess whether alternative monetary policy responses might have substantially reduced the scale of the inflation surge. Models therefore play an important role in strengthening our understanding of the recent inflationary surge and assessing the monetary policy response.

Model-based retrospective analysis provides several insights into the 2021-2022 inflation surges. The large forecast errors in the inflation outlook over this period were driven, at least initially, by energy and commodity price shocks, especially following the Russia-Ukraine war, and pandemic-related bottlenecks. Subsequently, changes in the transmission of shocks through the pricing chain, and in the behaviour of firms and consumers, likely played an important role in amplifying and propagating these shocks across the economy, converting relative price shocks into a general inflation shock.

Supply shocks, primarily originating from external sources, were key drivers of the inflation surges. While global and domestic surges in sectoral demand patterns also contributed to sectoral demand-supply mismatches (in the goods sector in 2020-2021 during the most intense phases of global pandemic lockdowns; in the services sector in 2022 during the post-pandemic reopening phase), the overall level of aggregate demand in the euro area was only barely above pre-pandemic levels by the end of 2022.

The pre-dominant role of supply shocks, combined with the fact that inflation expectations were initially signalling significant downside risks, supported the initial looking-through approach for monetary policy. In this context, it is also essential to recall the sequential nature of the shocks: the focus in 2021 was on pandemic-related supply disruptions and sectoral demand-supply mismatches, while the unjustified Russian invasion of Ukraine in February 2022 subsequently triggered extraordinary jumps in gas and oil prices.[2] The post-pandemic full-scale reopening of contact-intensive services sectors also took place in early 2022, after the ending of Omicron-related lockdowns. Put together, the second and third quarters of 2022 saw an extraordinary cocktail of inflation shocks, between the war-related commodity and supply chain shocks and the demand-supply mismatches in the reopening contact-intensive service sectors.

If policymakers had had perfect foresight about the shocks that were about to hit the economy, interest rates would have been raised earlier and more sharply. However, conditional on the real-time information available to policymakers (including how this information shaped baseline macroeconomic projections), monetary policy decisions in 2021-2022 were broadly in line with the policy paths indicated by the macroeconomic models.[3] This assessment includes both the initial phase in which monetary policy did not respond to the early stages of the rise in inflation and the subsequent phase of a sharp and sustained tightening cycle. This monetary policy response was, and continues to be, an important contributor to the disinflation process. Macroeconomic models have played a central role in helping policymakers in charting this monetary policy course, through their roles in: (a) macroeconomic forecasting; (b) estimating underlying inflation; and (c) calibrating the appropriate interest rate path.

This assessment puts the spotlight on the quality of the information set available to policymakers, especially in relation to the macroeconomic projections. I will cover this topic in the next section.

The 2021-2022 inflation surges: what did models miss?

The inflation surges in 2021 and 2022 surprised professional forecasters, both at the ECB and across other institutions and countries.[4] Inflation turned out to be much higher and more persistent than had been projected. This is clear from the very large and persistent forecast errors at both short and medium-term horizons in the Eurosystem and ECB staff projections for headline and core inflation.

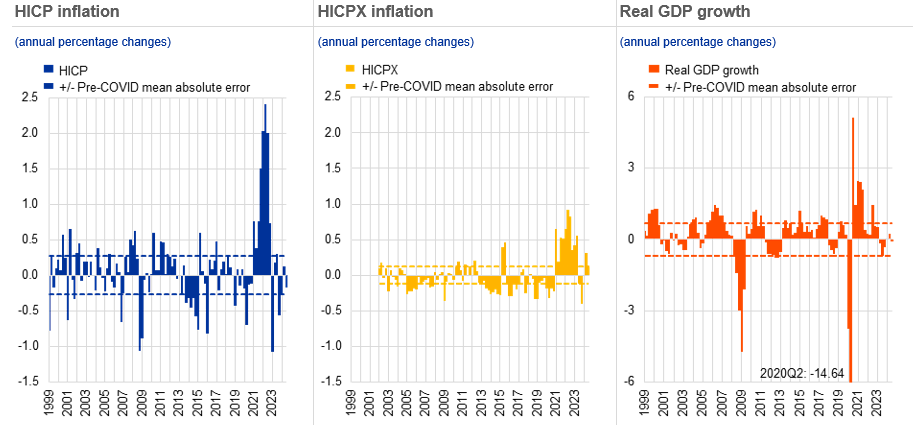

For example, forecast errors at the one-quarter ahead horizon during this period were more than five times larger than the average errors over the previous twenty years for headline inflation (and around twice as large for core inflation) and had the same direction for several successive quarters (Chart 1, left and middle panels). Indeed, the projection error in the December 2021 Broad Macroeconomic Projection Exercise (BMPE) for the year-over-year inflation rate at the end of 2022 was the largest ever, at around eight percentage points.

Projection errors were also materially larger than historical averages at medium-term horizons, with projections made early in the period suggesting that inflation would either return to target or fall below target well within the projection horizon. The errors in inflation at a four-quarter horizon, for example, were more than nine times larger during 2022 than the historic pre-pandemic average. This is important, since the medium-term inflation outlook is typically the most relevant for policymakers, given significant lags in the transmission of policy rate changes to inflation. The projection errors for GDP growth were smaller than for inflation, but still significantly above their historical range (Chart 1, right panel).

Chart 1

One-quarter-ahead errors in the inflation projections of Eurosystem/ECB staff

Sources: Eurosystem/ECB staff macroeconomic projections for the euro area and Eurostat.

Notes: An error is defined as the outturn for a given quarter minus the projection made for that quarter in the previous quarter (for example, the outturn for the fourth quarter of 2022 minus the figure projected for that quarter in the September 2022 ECB staff macroeconomic projections).

The latest observation is from the September 2024 ECB staff Macroeconomic Projection Exercise (MPE).

In understanding these large forecast errors over 2021-2022, it is important to differentiate between errors due to conditioning assumptions – especially linked to shocks to key variables such as energy or food prices – and errors in the way these assumptions were propagated through the forecasting models.

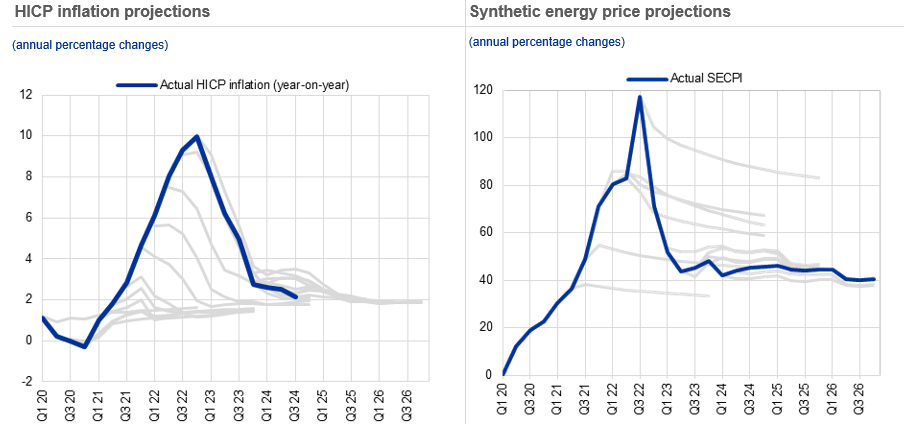

The starting point for the ECB staff projections is a set of conditioning assumptions for the future evolution of key input variables, known as “technical assumptions”.[5] For example, the paths for inputs such as commodity prices, including oil and gas prices, and short-term interest rates are based on market expectations at the time of the projection cut-off date.[6] The right panel of Chart 2 shows that the expected paths for oil and gas prices were revised up repeatedly over successive projection rounds at the end of 2021 and throughout 2022. This highlights how energy prices were repeatedly expected by markets – and therefore by our projection models – to decline. However, a sequence of upward surprises to energy prices materialised, especially following the Russian invasion of Ukraine. This sequence of shocks pushed up inflation and compounded forecast errors over successive projection rounds.

Chart 2

Headline inflation and energy composite projections from Q1 2020 to Q3 2024

Sources: Eurosystem/ECB staff projections and Eurostat for left-hand scale. Refinitiv and ECB staff calculations for right-hand scale.

Notes: Projections for the synthetic energy price index were introduced in 2021. Its methodology was changed in 2023. To account for this, projections before 2023 have been rebased to the new Synthetic Energy Commodity Price Index (SECPI) index.

The latest observation is from the September 2024 MPE for the left-hand scale and for the third quarter of 2024 for the right-hand scale.

In order to quantify the importance of energy price and other shocks in driving inflation projection errors, we can use models to construct counterfactual paths for inflation under a scenario in which forecasters had perfect foresight at each projection round about how energy prices and other conditioning variables would actually evolve over the projection horizon. This allows projection errors from incorrect technical assumptions to be isolated from the errors related to the transmission of shocks as embedded in models. Of course, the results from such a decomposition depend on the specific model. It is also important to keep in mind that the ECB/Eurosystem staff macroeconomic projections are not purely model based but also include staff judgement.[7]

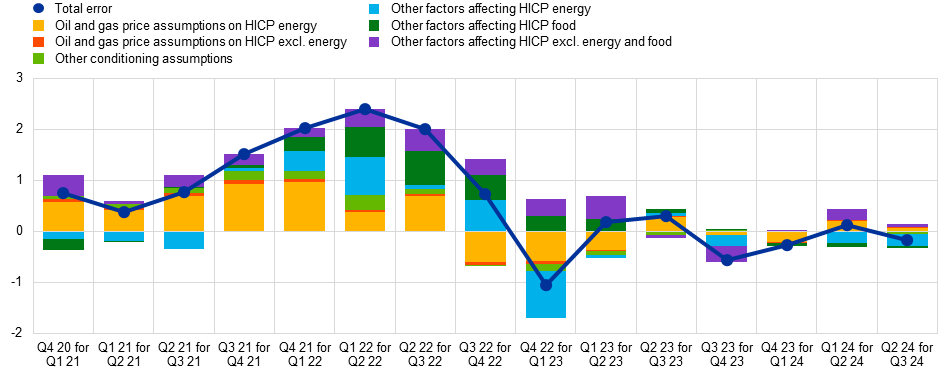

One way to carry out this counterfactual exercise is to use the Basic Model Elasticities (BMEs) of the Eurosystem national central banks (NCBs), which summarise the key relations between projection variables.[8] This exercise suggests that a substantial share of forecast errors for inflation during 2021 and 2022 was due to errors in the technical assumptions.[9] For example, errors in assumptions about oil and gas prices accounted for the majority of the one-quarter ahead inflation projection error until early 2022 (yellow and green bars in Chart 3).[10] Subsequently, however, the importance of other factors affecting food and core inflation grew in importance.

Chart 3

Decomposition of recent one-quarter-ahead HICP inflation errors in Eurosystem/ECB staff projections

(annual percentage points; percentage point contributions)

Source: ECB calculations. Notes: “Total error” is the outturn minus the projection. The labels on the horizontal axis indicate the quarter in which the projections were published and the quarter to which those projections relate (i.e. “Q4 20 for Q1 21” denotes projections for the first quarter of 2021 that were published in the fourth quarter of 2020). The decomposition is based on updated elasticities derived from Eurosystem staff macroeconomic projection models as at late 2023. “Other assumptions” refers to exchange rates, short and long-term interest rates, stock prices, foreign demand, competitors’ export prices and food prices”. The latest observation is from the June 2024 Eurosystem staff Broad Macroeconomic Projection Exercise (BMPE).

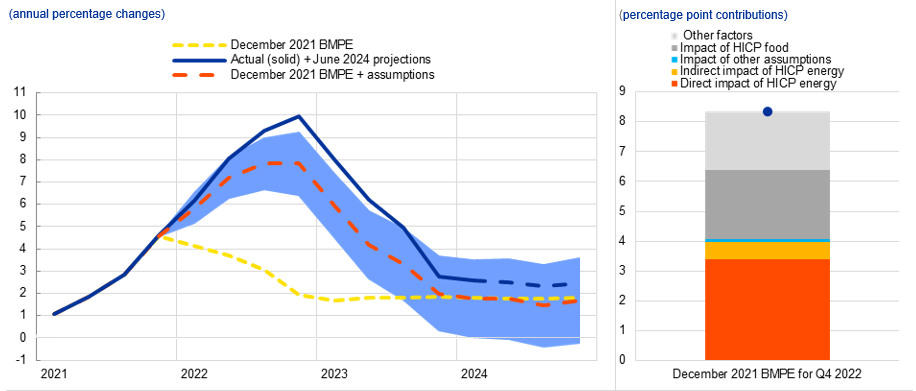

Further insight can be gained by running this counterfactual exercise in a fully-fledged macroeconomic model. ECB-BASE is the workhorse large-scale estimated semi-structural model used at the ECB to support and cross-check the staff projection exercises.[11] Decomposing the eight percentage point projection error at the peak of inflation in the fourth quarter of 2022 – relative to what had been projected in December 2021 – confirms that around half was due to unexpected developments in technical assumptions around oil and gas prices (red and yellow bars in Chart 4). Nearly one third, on the other hand, was due to errors in food inflation (dark grey bar in Chart 4), while the remainder was due to other factors that drove the error in core inflation (light grey bars in Chart 4). As such, errors in the set of technical assumptions go a long way towards explaining the forecast errors.[12]

At the same time, a sizeable share of the inflation forecast errors over this period cannot be explained by errors in the assumptions around energy and food prices. Two explanations for the remaining errors seem plausible.

The first explanation relates to statistical uncertainty. Macroeconomic forecasting models are underpinned by empirical estimates of model relations that are based on historical regularities. Statistical uncertainty around these estimates maps into statistical uncertainty around the central tendency of the inflation projection. Conditioning on the ex-post values for the technical assumptions, the statistical distribution around the inflation projections from the vantage point of December 2021 is relatively wide (Chart 4, blue area).[13] The actual inflation outturns (solid blue line in Chart 4) experienced during the inflation surge were close to the bounds of this model uncertainty, although inflation was still slightly too high to be compatible with the model in the second half of 2022 and the first half of 2023.

Overall, correcting for the actual path of energy prices and other conditioning variables, it cannot be ruled out that actual inflation was largely consistent with the historically-estimated statistical distribution around forecasts. This would imply that the economic relations estimated in the models to capture the transmission of shocks to inflation have remained broadly valid during the inflation surge, so long as the full statistical distribution is taken into account.

Chart 4

Decomposition of HICP inflation projection errors in December 2021 BMPE conditioning on December 2022 BMPE assumptions using ECB-BASE

Source: ECB-BASE, Eurostat, December 2021 BMPE and June 2024 BMPE.

Note: “December 2021 BMPE + assumptions” is simulated using the December BMPE baseline, but imposing the paths of HICP energy, HICP food and other technical assumptions from the June 2024 BMPE.

The second explanation is that economic relations might also have (temporarily) shifted during this extraordinary episode, including through an array of non-linear responses to the scale and combination of the shocks and the shift in the level of inflation. For example, in a high inflation environment, firms may adjust their prices more often than normal, in an attempt to pass on rapidly rising input and operational costs and protect their profits.[14] Furthermore, the broadening of the inflation shock from the energy sector (including via the food sector) to the services sector may also have been amplified during 2022 by the strong demand for contact-intensive services (tourism, hospitality) due to the reopening of these sectors after the final pandemic lockdowns. While costs were increasing quickly, the price elasticity of demand for services was plausibly atypically low due to this pandemic reopening phase, allowing for a greater pass-through of the cost shocks.

Furthermore, these conditions were ripe for a non-linear responses feedback loop between inflation and short-term inflation expectations. It is plausible that short-term inflation expectations are more sensitive to large inflation shocks than to small inflation shocks. Although longer-term inflation expectations remained broadly stable throughout, perceptions of past inflation and short-term expected inflation rates did increase in response to the inflation surges. In the event of a large inflation shock, an increase in near-term inflation expectations may take hold among households and firms, with firms anxious to avoid suffering relative price declines and households more likely to attribute individual price increases to general inflation than to a relative price increase.

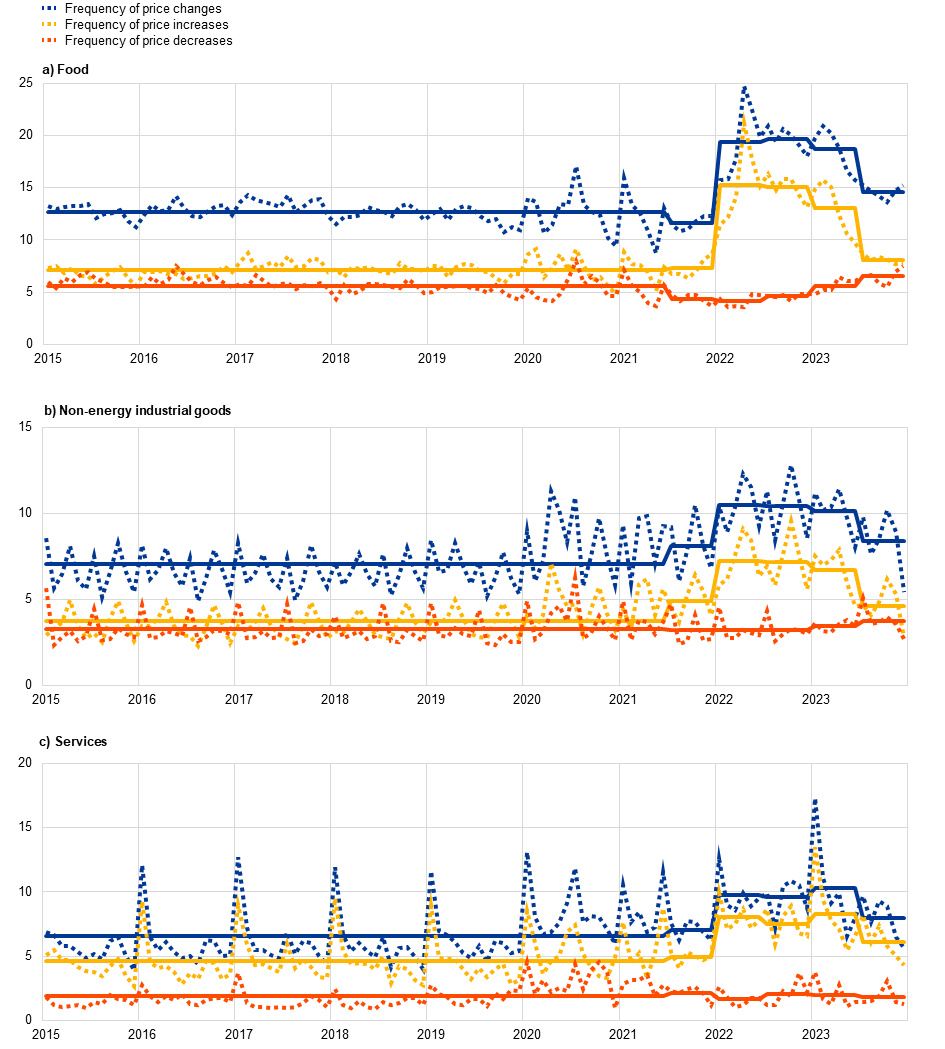

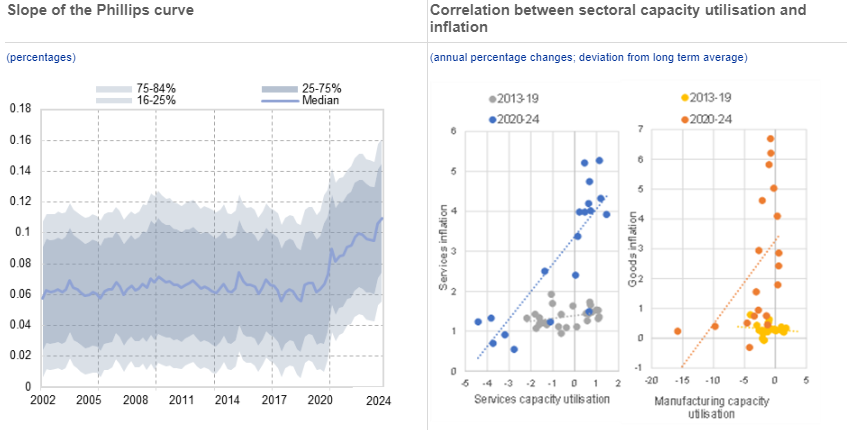

Indeed, the evidence suggests that there was a marked increase in the frequency of price increases over the course of 2022 (Chart 5).[15] This state-dependent increase in the frequency of price adjustments resulted in the faster-than-normal pass-through of the unique and large sectoral shocks. In terms of the key Phillips Curve macroeconomic relation between slack and inflation (whether at aggregate or sectoral levels), this can be interpreted as some combination of a shift up in the curve and an increase in the slope of the Phillips Curve. And indeed, estimates from a time-varying parameter model show some increase in the slope of the Phillips curve from early 2021 (Chart 6, left panel). Furthermore, the evidence based on sectoral data also shows a shift in the correlation between sectoral capacity utilisation and sectoral prices increases (Chart 6, right panel).[16] While the 2021-2022 inflation surges should not be interpreted as primarily originating in the recovery of product and labour markets from the 2020 pandemic lows, the domestic rebound added to overall inflationary pressures. I return to the contribution of domestic demand in the next section.

Chart 5

Frequency of consumer price changes over time, by aggregate product category

(percentages)

Sources: Consumer price micro-datasets from the national statistical institutes of Germany, Estonia, Spain, France, Italy, Latvia and Lithuania. Notes: The chart shows the weighted average frequencies of price changes (excluding sales). VAT changes in Germany (2020-21) and Spain (2020-23) have been excluded. The solid lines plot the average over the period 2015-21 and half-year averages over the period 2021-23. The latest observations are for December 2023.

Chart 6

Increasing pass-through from slack to inflation

Sources: Eurostat, DG-ECFIN and Eurosystem calculations.

Notes: Left chart: the Phillips curve specification relates the quarter-on-quarter growth rate of the seasonally adjusted HICP index to its own lag, capacity utilisation in industry, the lagged growth rate in import prices and medium-term survey-based inflation expectations. Time-varying parameter estimates where coefficients and log variance of residuals are assumed to follow a random walk. Right chart: services and manufacturing capacity utilisation are shown in deviation from the pre-COVID long-term average.

Faced with large forecast errors and significant uncertainty, ECB staff worked to develop new models and enhance the scenario analysis in the policy process. The new models developed include models of underlying inflation, satellite models that allow for alternative transmission channels, and machine learning models that try to allow for important non-linearities.[17] Each of these approaches can help to cross-check projections from the main forecasting models. In turn, the staff judgement element in the forecasting process enables the incorporation of the results from these supplementary analytical exercises, both in the baseline and in the risk assessment. No doubt the lessons learned from the 2021-2022 high inflation episode will prove to be especially valuable in the future if a similar configuration of shocks were to arise.

The recent experience certainly highlights the risks of over-reliance on baseline projections. Scenarios can be an effective way to represent risks when uncertainty is large or hard to quantify.[18] In 2020 and 2021, each set of quarterly staff projections included scenario analyses based on alternative assumptions regarding the future evolution of the pandemic and its economic consequences. In 2022, alternative scenarios focused on the economic consequences of the war in Ukraine, especially as regards uncertainties about energy supply. More recently, the scenario analysis has focused on more specific risks, such as a slowdown in the Chinese economy or a potential escalation of the conflict in the Red Sea area. In my May 2024 Stanford speech, I discussed how these alternative scenarios can be used to construct policy counterfactuals and will go into more details in a forthcoming speech on the use of scenarios to assess the robustness of alternative policy paths.[19] In addition to scenario analysis, the macroeconomic projections are accompanied by a large set of sensitivity analyses in relation to shifts in the technical assumptions and alternative parameter choices in model calibration.

Demand versus supply shocks

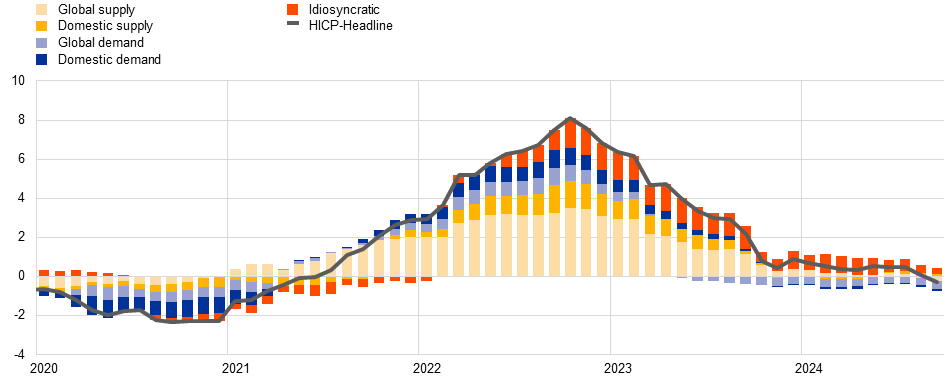

Models have also been deployed to interpret forecast errors through the lens of identified structural shocks and to quantify their contribution to inflation. Estimates from a large structural vector autoregressive (VAR) model – which employs sign and zero restrictions to identify the global and domestic demand and supply shocks driving deviations of inflation from the model-implied mean – indicate that external supply shocks were the main driver of the initial inflation surge in the euro area, although shocks to external demand and domestic demand also played a role, especially during 2022 (Chart 7).[20]

In particular, the shock decomposition points to various phases. The initial inflation increase was mainly driven by global supply shocks, related to supply chain disruptions, surging oil and gas prices and higher commodity prices more generally. These results supported an initially-circumspect monetary policy response, as the central bank still gathered evidence about the persistence of the inflation shock and its likelihood to affect materially expectations and other behavioural relations in the economy. In particular, in the absence of a clear understanding of the nature and expected persistence of the shocks, a more patient and deliberate policy response that weighs up the risks to different options, appeared appropriate.

In a second phase, the indirect effects from energy and food price spikes, as well as supply chain bottlenecks, passing through into core inflation led to the broadening of inflation pressures. Increasing demand, in particular in supply-constrained contact-intensive services, such as tourism and hospitality, added to inflationary pressures. Together with the risk that high inflation might de-stabilise inflation expectations, the increasing contribution of domestic demand add to the case for the aggressive monetary policy reaction that took place in this phase. In a third phase, as the energy and supply chain disruptions abated and monetary policy dampened demand, headline inflation started to decline rapidly.

Chart 7

Supply and demand drivers of inflation dynamics

(annual percentage changes and percentage change contributions; deviations from mean)

Sources: Eurostat, ECB, Eurosystem, and ECB staff calculations. Notes: historical decomposition based on a large BVAR model accounting for a rich set of inflation drivers, identified with zero and sign restrictions, see Bańbura, M., Bobeica, E. and Martínez Hernández, C., (2024) “What drives core inflation? The role of supply shocks”, ECB Working Paper No. 2875. The chart shows the deviations of HICP inflation from the mean implied by the model. The latest observation is for September 2024.

Of course, inference is sensitive to the type of model and the set of identifying assumptions.[21] A key challenge is to correctly capture the information set. A model needs to contain sufficient information to span the space of the structural shocks of interest. Otherwise, the correct shocks cannot be recovered from the history of observed variables. In stylised terms, the larger the model (or the more variables that are included), the more room there is to control for the different factors that affect inflation and, in particular, to separate out shocks from structural drivers.

This is particularly relevant when inflation is driven by a multifaceted and unusual set of shocks and structural drivers, originating both at home and abroad, as was the case over the 2021-2022 period. The dramatic fallout from the pandemic and the rapid bounce back following the reopening of economies after lockdowns are cases in point. In turn, amongst its many other effects, the shock of the Russian invasion of Ukraine constituted an extraordinarily-disruptive supply shock to the energy sector. As it turns out, models that rely on a small information set tend to assign a stronger role to demand factors and predict over-smooth dynamics of inflation and growth because such small-scale models are not designed to capture the type of sudden changes witnessed in that episode.[22]

The policy implications of model-based identification of demand and supply influences are not always easy to draw. That is, the policy implications not only depend on the source and nature of the shock but also its size and persistence. For example, a supply shock that is highly transitory (such as a temporary limitation in oil production in response to a short-lived geopolitical event) or a temporary surge in sectoral demand during the pandemic reopening phase (compounded by initially-limited supply capacity in the contact-intensive services sectors) may call for a looking-through policy response given the significant lags in the transmission of monetary policy.[23] By contrast, a string of large and persistent supply shocks in the same direction requires central banks to tighten in order to avoid longer-lasting inflation effects via wage-price spirals and dislocations in expectations.

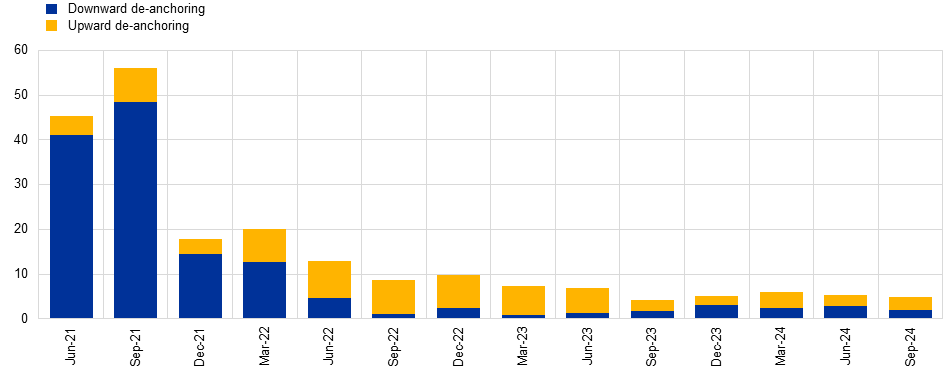

In relation to the latter risk, the de-anchoring of longer-term inflation expectations warrants close monitoring, and models can help policymakers understand the risks of de-anchoring under alternative shocks and scenarios. For instance, simulations using a regime-switching DSGE model suggest that substantial downward de-anchoring risks prevailed throughout most of 2021, due to the low inflation of the previous periods exerting a persistent dampening effect on expectations as well as the initial inflationary shocks being largely understood to be temporary in nature.[24] The further increase in inflation in early 2022 saw a rapid decline in downward de-anchoring risks and an increase in upward de-anchoring risks. The forceful policy response over the course of 2022 and 2023 helped to limit, and then reduce, these upward de-anchoring risks (Chart 8). Later on, risks became more balanced as inflation came down tangibly.

Chart 8

Risks of de-anchoring of medium-term inflation expectations

(percentage risk of upside and downside de-anchoring risks)

Sources: ECB calculations based on Christoffel, K. and Farkas, M. (2025), “Managing the Risks of Inflation Expectation De-anchoring”, IMF Working Paper Series, 2025, forthcoming. Notes: The charts show the risk of de-anchoring for the staff projections from June 2021 to September 2024. The simulations are based on a regime switching version of the NAWM I (Christoffel, K., Coenen, G. and Warne, A. (2007)), where the credible regime is defined as the estimated version of the NAWM I, with a fixed inflation target, the de-anchored regime is characterised by a time varying inflation target. Upward de-anchoring is defined as a situation in a de-anchoring episode, where the perceived inflation target is above 2%. The share of de-anchoring is based on 1,000 simulations over a ten-quarter evaluation horizon. The latest observations are from the September 2024 MPE.

The speed and strength of monetary policy transmission is also important when calibrating the appropriate monetary policy response.[25] Provided that monetary policy tightening transmits through to inflation in line with historical regularities, then our models should provide a good guide as to how fast and how far policy rates would need to be increased in response to the inflation shock. However, there is evidence that the aggressive rate hikes in response to inflation, and the highly restrictive monetary policy stance, have resulted in a faster-than-expected rise in lending rates as well as a larger contraction in credit flows, in particular to firms (Chart 9). This is important, because stronger-than-expected transmission would, all else being equal, call for smaller, or more gradual, rate increases in response to rising inflation.

Chart 9

Monetary policy transmission to firms and households compared to past cycles

(x-axis: years; y-axis: cumulative changes in percentage points for rates, credit growth in deviation from the start of the cycle

คำแนะนำการอ่านบทความนี้ : บางบทความในเว็บไซต์ ใช้ระบบแปลภาษาอัตโนมัติ คำศัพท์เฉพาะบางคำอาจจะทำให้ไม่เข้าใจ สามารถเปลี่ยนภาษาเว็บไซต์เป็นภาษาอังกฤษ หรือปรับเปลี่ยนภาษาในการใช้งานเว็บไซต์ได้ตามที่ถนัด บทความของเรารองรับการใช้งานได้หลากหลายภาษา หากใช้ระบบแปลภาษาที่เว็บไซต์ยังไม่เข้าใจ สามารถศึกษาเพิ่มเติมโดยคลิกลิ้งค์ที่มาของบทความนี้ตามลิ้งค์ที่อยู่ด้านล่างนี้

Source link